We recommend those who have invested in MEDDIC and have achieved adoption within the team to continue their investment. instead contemplate to integrate MEDDIC and SPICED. For the same reason you should not stop a marketing campaign, an email newsletter, or use of a CRM for that matter.

SPICED is a methodology that goes across the entire customer journey, and its focus is to integrate different methodologies so they speak the same language and are interoperable with each other.

SPICED used in Deal Qualification

One of the most commonly used methodologies in the sales process is MEDDIC. MEDDIC is the epitome of a departmental function, in that it is only applied in sales, and primarily used by sales professionals. It’s like the Lightsaber of the older generation. So, can we make MEDDIC interoperable with SPICED?

Applying MEDDIC to SaaS using SPICED

MEDDIC is a stage-based deal qualification methodology. It is particularly effective in complex sales environments where multiple stakeholders are involved. It emphasizes understanding the buyer’s needs, decision-making process, and key players within the organization. By addressing these critical aspects, sales teams can increase their chances of winning deals and minimize the risk of losing opportunities due to misunderstandings or misalignment. MEDDIC is an acronym that stands for:

(M) Metrics: Understanding the buyer’s specific metrics and Key Performance Indicators (KPIs) they must achieve.

(E) Economic Buyer: Identifying and engaging with the person with the authority to make purchasing decisions.

(D) Decision Criteria: Understanding the specific criteria the buyer will use to decide.

(D) Decision Process: Knowing the steps and timeline involved in the buyer’s decision-making process.

(I) Identify Pain: Uncovering the buyer’s challenges, problems, or pain points.

(C) Champion: Finding a champion or internal advocate within the buyer’s organization.

Whereas MEDDIC (and its derivatives) tells you where to pay attention, the SPICED approach’s framework reveals how to extract the information MEDDIC needs. What we are going to do next is demonstrate this by making MEDDIC interoperable with SPICED.

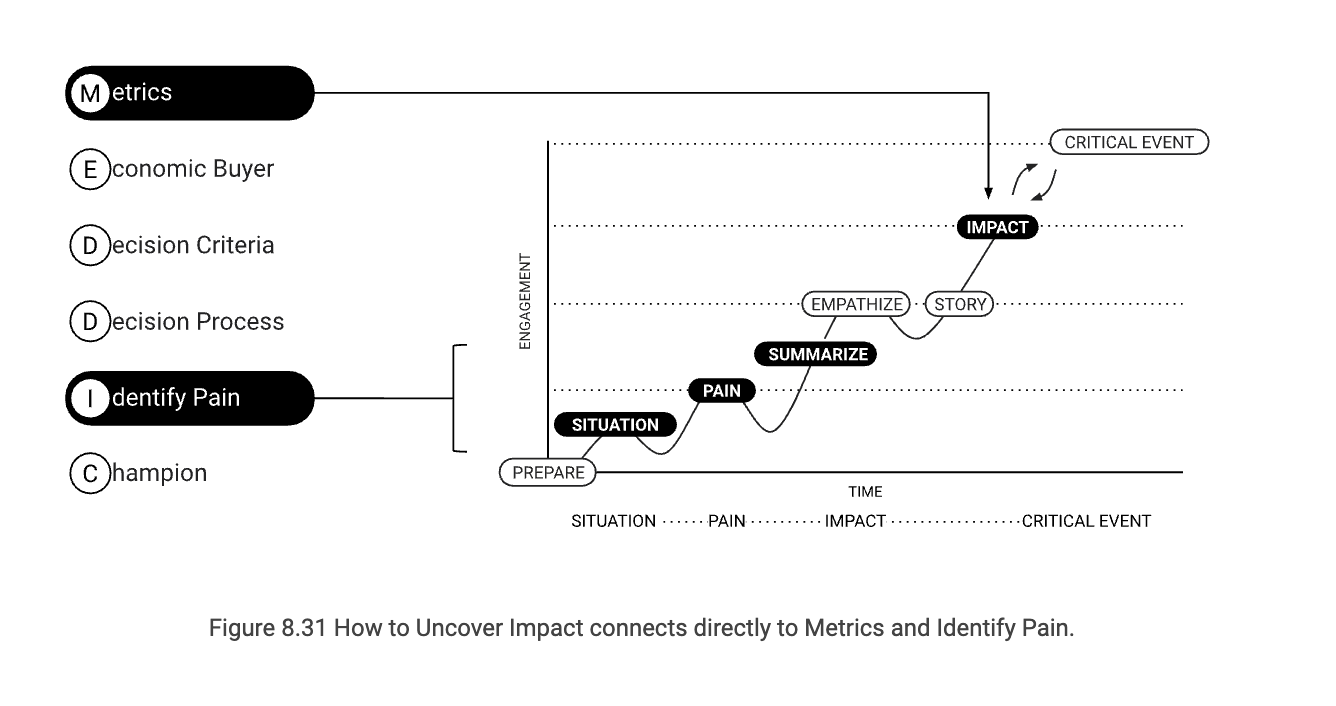

Step 1. Identify Pain and Metrics using the Impact Diagnosis Framework:

Identifying the metrics, as in the Impact your solution brings to the customer. The Impact-based framework 8.2.2 provides a 2-dimensional view of “How to Uncover Impact” and “Identify Pain.” It allows managers to leverage their investment in MEDDIC and expand that with a “and here is how you can” – from Knowledge to Know-how.

Whereas MEDDIC only looks for the rational impact, it shows you that through SPICED it also offers you emotional impact. It is amazing how robust MEDDIC still is 25 years after its conception.

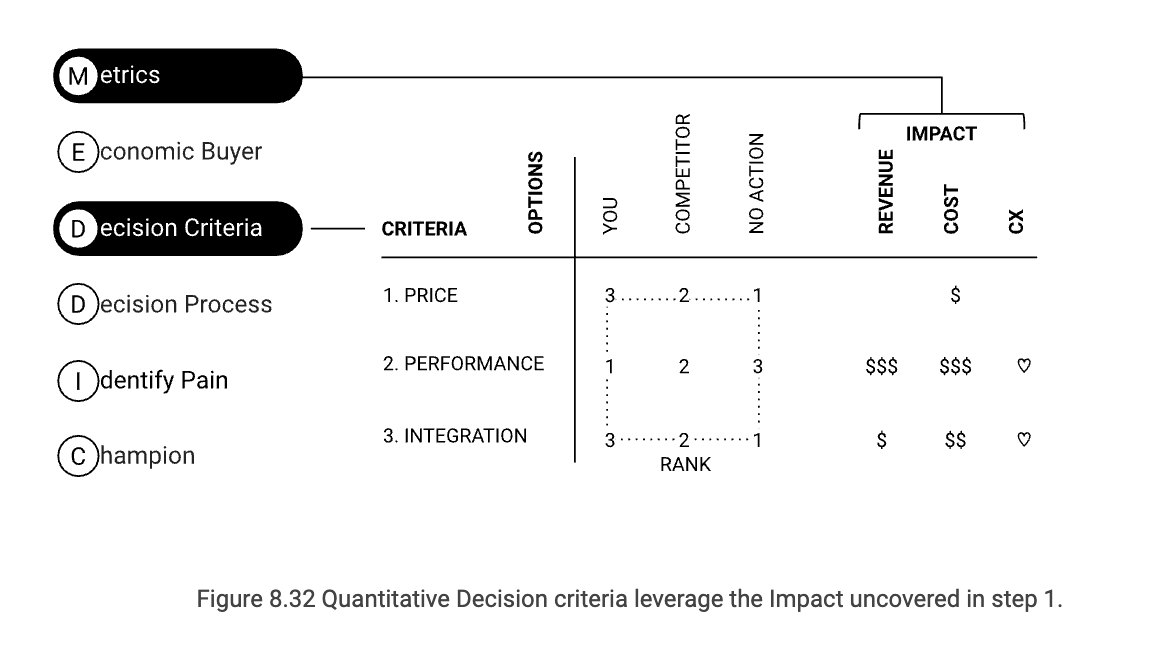

Step 2. Determine the Decision Criteria using Impact.

Once we have identified the Impact, we can make it part of the Decision Criteria, in which we help customers establish the rational Impact so they can communicate with their stakeholders using a quantitative approach.

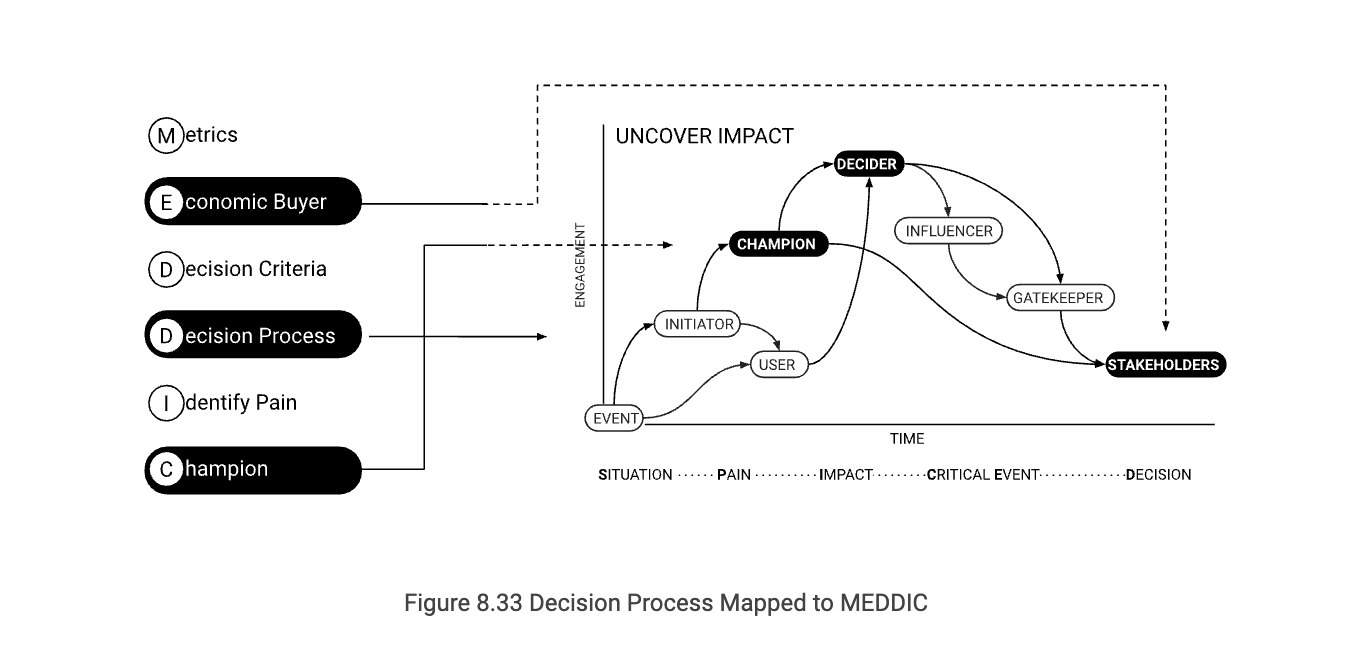

Step 3. Determine the Decision Process using SPICED

Historically, MEDDIC was used for perpetual software sales, priced in the millions of dollars, explaining the focus on getting consensus across a wide variety of decision-makers involved in the Decision process. Combining MEDDIC with the role of a buying center provides a roadmap that allows managers to tell what needs to happen and how to do it. For example, many sales managers have tasked their sales reps over time to “get to the decision-maker (decider).” With SPICED, we have learned that a champion is triggered by Impact and a decider by the date they need that Impact (Critical Event).

What is common across these three steps is that MEDDIC explains WHAT needs to happen, and SPICED; SPICED does this by connecting all elements of MEDDIC to IMPACT, creating a common connection between all elements of SPICED but, more importantly, building a bridge to marketing campaigns and customer success functions. SPICED gives an idea of HOW to make this happen and translates this to operational actions.

A comparison MEDDIC vs. SPICED

We get asked all the time what is the main difference between MEDDIC vs. SPICED, they are two very different approaches.

Comparison of SPICED and MEDDIC

| ASPECT | SPICED | MEDDIC |

| Origins | By WbD Established in 2012 for SaaS businesses. | Established in 1996 for Perpetual Software Sales. |

| Business Model | Subscription-based model. | Ownership-based model. |

| Metrics | Based on the full customer journey | Based on the sales funnel |

| Forecasting | Based on actions | Based on stages |

| Organization | Sales

Marketing Customer Success Product Management |

Sales |

| Sales Motions | Dedicated touch.(Strategic Accounts)

High-Touch (Enterprise) Mid-Touch (SMB) Low-Touch (Groups) No Touch (Pro-users) |

Dedicated touch.(Strategic Accounts)

High-Touch (Enterprise) |

| Target Audience | Seller with 5+ years of experience. | Seller with 20+ years of experience. |

| Action vs. Direction | Action Driven: Provides a how-to approach, giving actionable insights. | Direction Driven; tells you what needs to be done next. |

| Cross-Functional Communication | Uniform methodology for cross- departmental communication | Used to improve forecasting,

inter-departmental communication. |

| Integrated Sales Methodology | High velocity selling Provocative selling Consultative selling Solution selling Transactional |

Consultative selling |

| Supported roles in the Buyer Center | User

Initiator Champion Decider Gatekeeper Influencer Stakeholders |

Champion

Decider. |

| Primary Focus | Customer-centric

Focus on establishing impact. |

Seller-centric

Aimed at closing deals. |

| Focus Area | Centers on Priority, and RoI.. In SaaS every deal has a 10-100x RoI. |

Centers on RoI. |

| Set Theory Terms | SPICED has additional elements that cannot be found in MEDDIC. | All elements of MEDDIC can be found within the SPICED methodology. |

| Example | SPICED is used to target the right customer. During the sales process, it focuses on how to identify impact using question-based techniques and determines how this affects the decision criteria. It helps identify who is involved in the decision process. It can use a solution architect to help set a priority for the service against other SaaS purchases. Once a decision is made, it facilitates a seamless transition to the customer success team to pursue impact. | MEDDIC is used by the manager to check if a seller has performed an action. It relies on the seller to find a satisfactory answer, centered on RoI. It focuses on competitive advantages. It works closely with a sales engineer to provide a turn-key solution to the customer. |

Here’s a comparison between SPICED and MEDDIC, focusing on their efficacy in B2B software sales.

SPICED

Framework Components:

S: Situation: Current context where the prospect operates.

P: Pain: Problems or challenges faced by the prospect.

I: Impact: Emotional and rational consequences.

C: Critical Event: Time-sensitive triggers.

D: Decision: Decision-making process and criteria.

Methodology:

- Utilizes question-based selling during the discovery process.

- Incorporates storytelling where the “hero” is a person at the customer’s organization.

- Focuses strongly on both rational and emotional “Impact.”

Strengths in B2B Software Sales:

- Emotional storytelling and question-based selling make it highly adaptable and customer-centric.

- Capable of capturing a more holistic understanding of the customer.

- Well-suited for solutions where differentiation is crucial, even in crowded markets.

MEDDIC

Framework Components:

M: Metrics: Quantifiable economic benefits.

E: Economic Buyer: Person who controls the budget.

D: Decision Criteria: Standards for evaluating solutions.

D: Decision Process: Organizational procedure for buying.

I: Identify Pain: Business challenges needing resolution.

C: Champion: Advocate within the customer organization.

Methodology:

- More structured and metrics-driven.

- Typically does not integrate storytelling as a core component (though it could be adapted to include it).

Strengths in B2B Software Sales:

- Strong in environments where quantitative ROI is a primary concern.

- Ideal for complex sales involving multiple stakeholders.

- Often used in longer sales cycles and high-value deals.

Comparing the Two in B2B Software Sales:

- Depth of Understanding: SPICED’s question-based selling may provide a more comprehensive view of individual motivations. MEDDIC, on the other hand, excels at understanding organizational structures and metrics.

- Emotional Connection: SPICED explicitly focuses on emotional impact and incorporates it into storytelling, making it more engaging on a personal level. MEDDIC is more data-driven and may not explicitly account for emotional factors.

- Sales Cycle and Complexity: MEDDIC often shines in complex, long-cycle sales typical of large enterprise solutions. SPICED can be more agile and better suited for shorter cycles or less complex solutions.

- Decision-Making: Both frameworks address the decision-making process but from different angles. SPICED delves into emotional and rational impacts affecting the decision, while MEDDIC focuses on criteria and processes.

- Customer-Centric vs. Process-Centric: SPICED, with its storytelling and question-based methodology, can create a more customer-centric experience. MEDDIC tends to be more process-centric, focusing on the systematic progression of a sale through an organization.

The choice between SPICED and MEDDIC may depend on your specific sales environment, the complexity of your product, and the emotional vs. rational drivers you find most effective for engaging your prospects. Both frameworks have merits; understanding their distinct advantages can help you tailor your sales strategy accordingly.