What is a Target Account List?

As digital marketing continues to evolve, the most successful B2B companies are putting more and more emphasis on targeting the right accounts. They don’t want to waste time and money reaching out to potential customers who have no interest in their product.

The answer for a growing number of B2B companies is account-based marketing. Instead of reaching out to as many potential customers as possible and hoping that a few of them might be interested, ABM is laser-focused on those that would be the best fit. It then prioritizes this list of prospects and puts together a personalized plan for each of them.

According to a survey of B2B companies conducted by LinkedIn, more than 80% of companies said they plan to boost their ABM budget over the next year. And well over half said it’s already an important part of their sales and marketing efforts.

The key ingredient of an ABM campaign is a target account list. What is a target account list? It’s the first step in implementing a successful target list marketing strategy – very simply, it’s a rundown of all of the accounts that you’ll be targeting.

How to Create a Target Account List

Target account list creation isn’t always easy. More than a third of marketing teams say it’s one of the biggest challenges in running an ABM campaign. But the effort pays off in the end. About 87% of marketers say that ABM delivers a higher ROI than other types of marketing campaigns.

An ABM campaign takes a “flipped funnel” approach, meaning that it’s limited to a smaller number of prospects. Because of that, selecting and prioritizing your target accounts is the most important part of the process.

How do you narrow down your list of prospects? Your target account list should be based on your ideal customer profile — the description of the type of customer that would most likely take advantage of your product. Since your sales team can’t follow up on every lead, you should use your ICP to decide which leads are the right fit for your company.

ICPs are extremely useful to any team that’s new to account-based marketing. Along with targeting accounts that are a good fit for your company, they also help you define the problem you’re solving for, align your product with the needs of your customers, and create a roadmap for future sales. And by using this approach, you are naturally aligning your product, marketing, and sales teams to the same operating framework.

Although some people use them interchangeably, an ideal customer profile (the type of company that you are targeting) is not the same as a user persona (the specific person or the type of person within that company you are hoping to reach). Both are useful, but the ICP is what you need to develop for account-based marketing.

How to Create an Ideal Customer Profile

To create an ICP, the first step should be to compile a complete list of your current customers. Start to narrow that list down to include just the customers who have gotten the most out of your product. A good place to start is with the customers who have signed the biggest contracts, as well as those who have increased the size of their contracts since the initial sale. Customers who have made the most referrals may also be good candidates. If you’re a SaaS company, include customers who are your most active users.

Once you have a list of your best current customers, begin looking for commonalities. Here are a few characteristics to keep an eye out for:

- Industry or vertical: Are most of your customers within particular industries?

- Geography: Are they clustered in the same region, country, or continent?

- Company size: Do they have similar annual budgets or revenues?

- Number of employees: Do they have roughly the same sized workforce?

- Customer base: What type of customers use their products (e.g., customers in particular industries, or of a certain size)?

- Company maturity: How many years have they been around?

- Company status: Are they for-profit or not-for-profit? Public or private?

Once you have compiled this information, you can start to define your ICP. Every ICP looks different, but this general format is a good starting point:

“Our ideal client is a North America-based SaaS company with a recurring revenue model. It’s in growth stage, and has a customer base mostly made up of small- and medium-sized businesses.”

There are a lot of templates that can help you put together an ICP, but there’s no reason you can’t create one on your own. Once you have an ICP that your team agrees on, you can start to populate your target account list with specific companies.

How to Identify and Build Your Target Account List

Before your sales and marketing teams begin working together on the list of accounts you want to target, take some time to talk about goals. Are you simply looking to expand your customer base, or is it something more specific? Maybe you want to acquire a couple of impressive logos to use in your promotional materials, or perhaps reactivate accounts that moved on to other companies. Agree on the goal, and then use that as input to determine which accounts to target.

The better your list, the higher your conversion rate. Be sure you take advantage of both firmographic and technographic data. Firmographic data is information that can be used to categorize a company, such as industry, location, number of clients, or annual revenue. It’s used to segment companies into categories that make sense for your purposes. Technographic data is the technology that a company uses on a day-to-day basis. You can use both types of data to figure out if a company aligns with your ICP. Both firmographic and technographic data are publicly available via tools that can gather this information for you.

Note that as you gather this firmographic and technographic data, it may not be completely up to date; therefore you should also collect information on in-market buyers. This real-time data lets you know which companies are already in the market for your product or service

If possible, your target account list should be made up of prospects that have already demonstrated some amount of interest in your company (such as they have visited your website, downloaded your content, or registered for your events).

Apply Your ICP to the Target Account List

Once you have gathered a master list of target accounts, it’s time to start winnowing it down. Apply your ICP to the accounts, looking for the attributes that your best customers have in common. Loading the master list into your CRM makes filtering much easier.

It’s not always obvious which of these target accounts would be the best fit. For example, one that’s in the right industry might have a smaller annual recurring revenue than most of your current customers. That might not knock it out of the running, but it does make it a lower priority.

Create a Tiered List of Companies for Target Account Selling

You’re unlikely to be able to reach out to all the prospects on your list, so it’s time to prioritize them. The point is to be able to focus your team’s energy on those that are most likely to convert to sales. A three-tiered system works best for most companies.

- Tier 1: These accounts are a perfect fit for your company. In most respects, they will be very similar to your best current customers.

- Tier 2: These accounts fit most of the criteria you’ve put together. They resemble your current customers, but might have one or two differences.

- Tier 3: Probably the largest of the three tiers, these accounts are more of a long shot. They are worth pursuing, but not worth investing too much time and effort.

Here are some examples of recommended calculations based on sample GTM strategies by using 3 key data points:

| GTM MODEL | EXAMPLE | RECOMMENDED CALCULATIONS |

| Named Accounts |

|

Total Target Accounts: 500 Tier 1: 60 Accounts Tier 2: 100 Accounts Tier 3: 240 Accounts |

| Field Sales |

|

Total Target Accounts: 1500 Tier 1: 240 Accounts Tier 2: 300 Accounts Tier 3: 960 Accounts |

| Two-Stage |

|

Total Target Accounts: 3500 Tier 1: 1000 Accounts Tier 2: 700 Accounts Tier 3: 184 Accounts |

Align Your Team with the Target Account List

While you’re putting together your target account list, make sure to hold regular sales and marketing alignment meetings to make sure everyone is on the same page in terms of target account selling strategies. If this is your company’s first time with an ABM campaign, it’s worth taking the time to define the terms you’re using; different teams within the same company will often use different terminology to mean the same thing.

Once you have broken down your list into tiers, it’s time for the sales team to start target account selling. Check in frequently to make sure that the list you’ve put together is feasible for them to address (for instance, that the list isn’t too long and takes too much time for them to do their outreach); it’s easier to make adjustments early on in the process.

Measuring the Success of Your Target Account List

These key metrics are perhaps the best indicators of the overall success of your ABM campaign.

- Engagement. Since your team is reaching out to accounts with highly personalized content, there should be a measurable increase in engagement. If not, you should reconsider whether the content that you are sending out aligns with the pain points that your customers are trying to solve.

- Contract value. Most companies see a significantly higher ROI when they switch to ABM. As your team begins to close deals from these efforts, look for a rise in your average contract value. If there’s no increase, take another look at the firmographic and technographic data you used, making sure the target accounts are the best fit for your company.

- Sales cycle. Many companies experience a shorter sales cycle with ABM, but if yours is longer at first, you shouldn’t be surprised. This is a highly personalized process that can take time. Track the sales cycle over time, and you should start to see improvement.

Ongoing Target Account List Management

Be sure to revisit your target account list and tiering model on a quarterly basis to adapt to changes in your staffing, incorporate learnings, and revise your criteria. Don’t refresh more than 20% of your target account list per quarter to allow time for accounts to engage with and respond to your outreach.

Use the Target Account List Calculator

Want to try it for yourself? Using a few key data points, our targeted account list calculator lets you determine your total accounts as well as the number of accounts you should have per tier.

Enterprise go-to-market teams are challenged now more than ever to engage executives to build pipeline and grow existing customers. At the same time, executives are more overwhelmed than ever with digital marketing and communications.

The average professional receives 120 emails per day. With the deluge of digital communications and voicemails, marketing teams are having a hard time standing out above the fray and getting executives from key accounts to engage. How can teams move beyond the usual channels of email and voicemail to reach these key decision-makers?

The two main components of reaching executives are the message you use and the channels you approach them on.

First off, delivering compelling value in your message is key to any executive outreach. At the low end, we often see messaging that requests “15 minutes of your time” to speak with an account executive. While this may be your team’s goal, it is not of compelling value to most executives.

Instead, focus on delivering value in three key areas: High-value content, notoriety, and networking opportunities.

Figure 1: types of value exchange offers that resonate with executives

Some examples of offerings in these areas that have worked for customers include:

High-Value Content: Providing executives with relevant insights they did not already know is a great way to build trust and credibility. One customer of ours, Hired, would send out a regional report on the state of recruiting trends in each city to executives in that region. This was high-value information for recruiting leaders and department leads.

Notoriety: Flattery is a great way to engage executives. One SaaS legal research provider, Casetext, started a podcast on legal research topics and invited senior partners at key law firms to be guests on the podcast. This turned out to be a great way to engage senior leaders.

Networking: Access to talent that executives would find relevant and exclusive is also key. One customer in the security space set up executive roundtables with a notable healthcare CTO, and then invited area CTOs of key hospitals to join in an exclusive discussion.

Not all value exchanges are created equal, and the higher the value, the more likely you are to convert. However, you will need to weigh quality versus quantity to scale your programs. Depending on whether you are implementing 1-1 account plays, 1-few, or 1-many, this framework will help you think about and hone in on the optimal value exchange offer.

Figure 2 The higher the value exchange, the more likely you are to convert.

Once you know what value you want to offer, the next step is finding the channels that work for your audience. Personal preference and the type of executives you’re targeting play a part here, but there are key channels that perform better across the board with executives and different stages of the funnel.

Figure 3 Key executive channels across the buyer’s journey.

The key here is testing and monitoring signals to understand what is working, and then continuing to evolve your programs with the optimal channel mix. For example, for some clients in the security and technical space, we have found little value in running targeted, account based advertising: many CTOs and CSOs block ads, or the ads fail to resonate with them. On the other hand, a marketing executive may be thrilled to see a relevant and targeted message.

Pulling it all together with well-crafted messaging, touchpoints, and orchestration is the key to a winning account play.

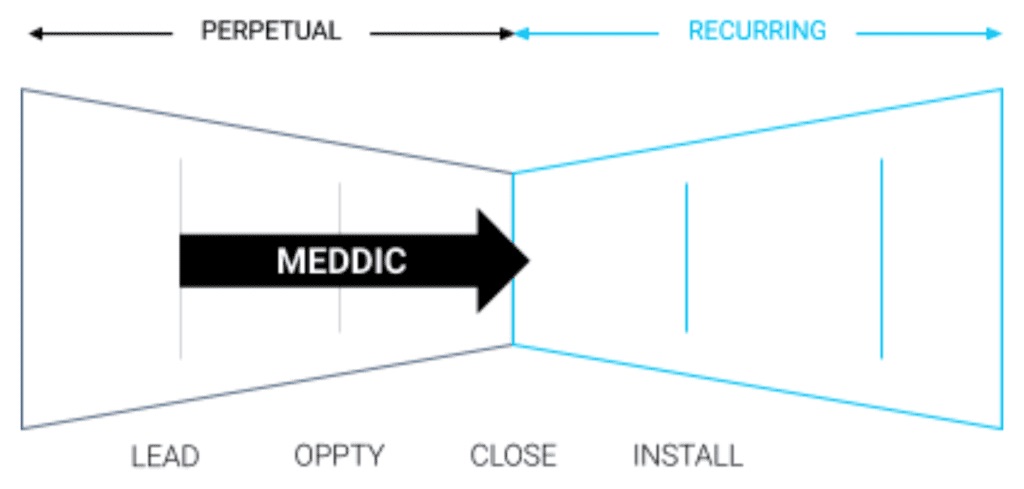

MEDDIC has long been one of the most effective sales methodologies used in enterprise sales. In the years since MEDDIC was originally developed, the focus of sales has shifted to the idea that recurring revenue happens after you close a deal. And while MEDDIC works quite well for a seller-centric sales motion that primarily focuses on closing deals, it provides less guidance for what happens after the deal is closed (Figure 1). Recent updates with derivatives such as ‘MEDDPIC’ (Paperwork) and ‘MEDDICC’ (Competition) add an even greater focus on closing. This extreme focus on closing causes challenges when applied to a recurring revenue business, such as SaaS.

Figure 1. The application of MEDDIC in Enterprise Sales

In SaaS, the revenue is not paid up front, but spread over months or years. It is quite common for a profit to be realized 9 to 18 months (Ref. 2.) after the client makes a commitment. Any time after committing, if the client does not experience the impact they are looking for, they can and will cancel. So to earn a profit, you need a recurring revenue stream — and to earn that, you need to provide the recurring impact a client wants. The focus on “closing a deal” not only increases the churn — it increases the losses.

This demonstrates that we need to think differently here, that we need to treat a SaaS deal different from a perpetual one. Here are a few considerations:

- Recurring revenue is the result of recurring impact: Gaining commitment from the right clients means that you first must understand the impact that clients are seeking.

- Priority, not budget: SaaS clients buy dozens of SaaS products, and their decision is not based on “Do we have a budget?” but rather, “Is this a priority?” So you must understand if the impact you can deliver matches up to your client’s priorities.

- Company wide, not just the sales team: In SaaS, all departments (whether they realize this or not) are connected through the concept of Impact: Marketing raises awareness of the impact you can provide, the Sales team qualifies prospects based on the ability to deliver impact, and Customer Success is responsible for helping customers realize the impact that you have promised.

- The risk is no longer on just the buyer: With perpetual sales such as hardware, the risk mainly lies with the buyer; no seller will be fired for selling too much. However in SaaS, similar to a rental car company leasing out a car, the seller also faces certain risks, because the buyer will cancel if they do not realize the recurring impact they are expecting.

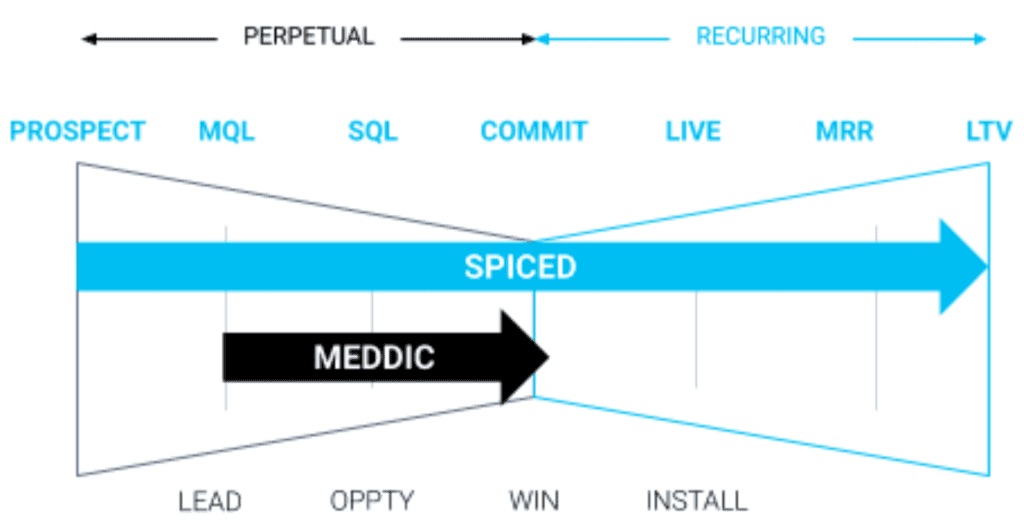

To fill this gap, consider SPICED — a customer-centric diagnostic framework that focuses on delivering the customer’s desired impact, on a recurring basis. The methodology is based on the fundamental principle that recurring revenue comes from recurring impact (Figure 2). By using SPICED and MEDDIC in combination, a SaaS revenue team can apply these methods together to successfully drive recurring revenue.

Figure 2. The application of a methodology to apply to Recurring Revenue

Many SaaS companies using methodologies designed for perpetual licenses (Ref. 3, 4, 5, 6) are starting to see their conversion rates decline, and this is because their sales teams are not well equipped with a sales process that matches with the actual journey that a SaaS customer takes. By focusing their process only on closing the deal, those companies are preventing their Go To Market teams from providing the true impact to customers of which they are capable.

We have created a methodology specific to a recurring revenue business, in order to address the full customer journey. This methodology is called SPICED. You can see in Figure 3 that MEDD(P)ICC focuses on the criteria that the seller needs to close the deal, while SPICED is a customer centric methodology that focuses on helping the customer realize the impact they are seeking.

How to Make MEDDIC Work in a SaaS Model

MEDDIC can be applied quite effectively in a Software as a Service (SaaS) sales model, by combining it with the SPICED diagnostic framework. Consider the following tips to implement the MEDDIC framework in your SaaS sales process:

Qualification vs. Sales Methodologies

A sales process is a series of actions you must take in the correct sequence to achieve results. To give a customer an outstanding experience, place your actions into stages. Each stage includes a series of actions you will perform in the correct order. A proper sales methodology typically includes the following approximate stages:

- Identify

- Diagnose

- Assist

- Navigate

- Recommend

- Trade

- Commit

Typical lead qualification methodologies are based on the idea that qualification only needs to occur as a one-time event. However, the MEDDIC framework is a deal qualification methodology that operates on the idea that qualification should be performed consistently across every stage and action of the sales process.

Sales methodologies are meant to enable the buying experience that we create for customers. But if one methodology focuses on lead qualification, one focuses on deal qualification, and another focuses on deal closing — then this means that a revenue team would need to combine several methodologies at once, which can be quite challenging. It also ends up with different groups within the the same revenue team speaking different languages: for instance, the SDRs qualify using BANT, the AEs use the MEDDIC methodology, and Marketing uses the AIDA framework.

SPICED vs. MEDDIC

MEDDIC is historically based on the idea that growth comes from closing more new logos, which is of course true and cannot be ignored. However, this approach considers anything that happens after the deal is closed to be a much less important.

An alternative first principle that must be applied for a SaaS business is that recurring revenue leads to recurring impact. This means that helping the customer achieve their desired impact motivates them to continue buying more. If you continuously provide value to customers, they will keep buying from you. Because this method is impact-centric, it is automatically customer-centric. The more impact a customer receives, the more they continue to buy over time, and the more revenue is generated as a result.

SPICED is a diagnostic framework that allows for a uniform customer-centric approach, facilitating handoffs, and providing a consistent, high-quality experience for the customer. SPICED can help any AE, SDR, or CSM provide more impact to their customers by applying the diagnostic framework, which includes the following:

- Situation: Background facts or circumstances relevant to the customer’s world. These describe objective factors that determine whether the customer falls within your ideal customer profile and what is happening in their world. Factors such as size of company, number of employees, software they use, hiring needs, security needs, or revenue goals.

- Pain: The problems the customer has purchased your product or solution to help solve. This could include the need to conduct training or recruit, support a global team, pass a security audit, or stop errors to happen in a process.

- Impact: The results produced by solving pain. These are the outcomes the customer is trying to achieve by purchasing your solution. Impact can be both emotional (for individuals) and rational (for companies).

- Critical Event: Any particular deadline by which to the customer must achieve the desired impact or suffer negative consequences. Critical Events drive the customer’s timeline for a purchase.

- Decision Criteria: The people involved in the decision, the process they will follow to reach that decision, and the criteria they will use to evaluate the right solution.

The key difference between SPICED and MEDDIC is each framework’s focus and origins. MEDDIC originates from perpetual software sales and focuses heavily on the decision stage of the sales process. SPICED is based on recurring revenue, so it focuses on achieving continual recurring impact.

And yes, SPICED and MEDDIC can operate in the same world and work together. Let’s examine MEDDIC to see how this can occur…

MEDDIC (Ref. 7) consists of the following factors:

- Metrics

- Economic buyer

- Decision criteria

- Decision process

- Identifying pain

- Champion

MEDDIC is based on the concept that if you take the right actions, the desired results will automatically follow. It requires inspecting the actions of sales teams to ensure they take the right steps, rather than simply expecting them to achieve results. MEDDIC operates in the following ways:

- Functions as a common language

- Allows you to achieve adoption through engagement

- Manages activity instead of results

- Examines the deal primarily from the seller’s point of view rather than the customer’s point of view

MEDDIC focuses primarily on closing the deal; while winning the deal is an element of growth, it cannot increase growth on its own. Rather, growth increases when you sell based on impact. This means that SaaS revenue leaders need to measure impact-based metrics; the savvy SaaS revenue leader knows that it’s crucial to close the right deals and gain the customers who will stay with you long-term, so you can continue impacting them positively over time.

Application of SPICED for MEDDIC Alumni

If you are a MEDDIC alumni, applying the SPICED framework is easier than you might think. There are two key areas that must be supplemented: Impact and Decision Criteria.

How to sell on Impact

To make MEDDIC compliant with a recurring revenue business, you have to understand that MEDDIC looks at metrics with a focus on growing revenue and reducing costs. It highlights the importance of an economic, or rational, impact that a solution provides to a customer.

A rational impact is quantitative and measurable. However, experts have also discovered the importance of emotional impact. Emotional impact is qualitative, based on how a product or service makes customers feel.

MEDDIC directs sellers to focus only on rational impact, while SPICED looks at both rational and emotional impact. You can apply the emotional impact to MEDDIC, as long as you identify it. This guideline typically helps: a rational impact is typically the same or similar across all people involved in a decision, but an emotional impact varies by person.

QUOTE: A rational impact is typically the same or similar across all people involved in a decision, but an emotional impact varies by person.

In the MEDDIC framework, you can identify the emotional impact by identifying pain points. Then, when you move to the decision process, you can sell the emotional impact to the champion, and then provide them with the rational impact to take back to their boss or company.

Influencing the Decision Criteria

The decision criteria in the MEDDIC framework are based on priority. You must determine what the customer’s priority is so they can compare factors and rationalize their decision. This way, you can show the customer how your product or service surpasses what competitors can offer. Apply the MEDDIC framework by translating the decision criteria into impact in the following ways:

- De-prioritize: Clarify with the customer that the price has a relatively small negative impact on their budget, relative to the increase in revenue or productivity that they will see as a result. This will help them understand that price is actually the least important factor.

- Prioritize: Introduce a new element, such as adding a new criterion or pointing out the ability to unlock a new revenue stream.

- Re-prioritize: Educate the buyer by sharing current customer success stories or introducing them to a current customer.

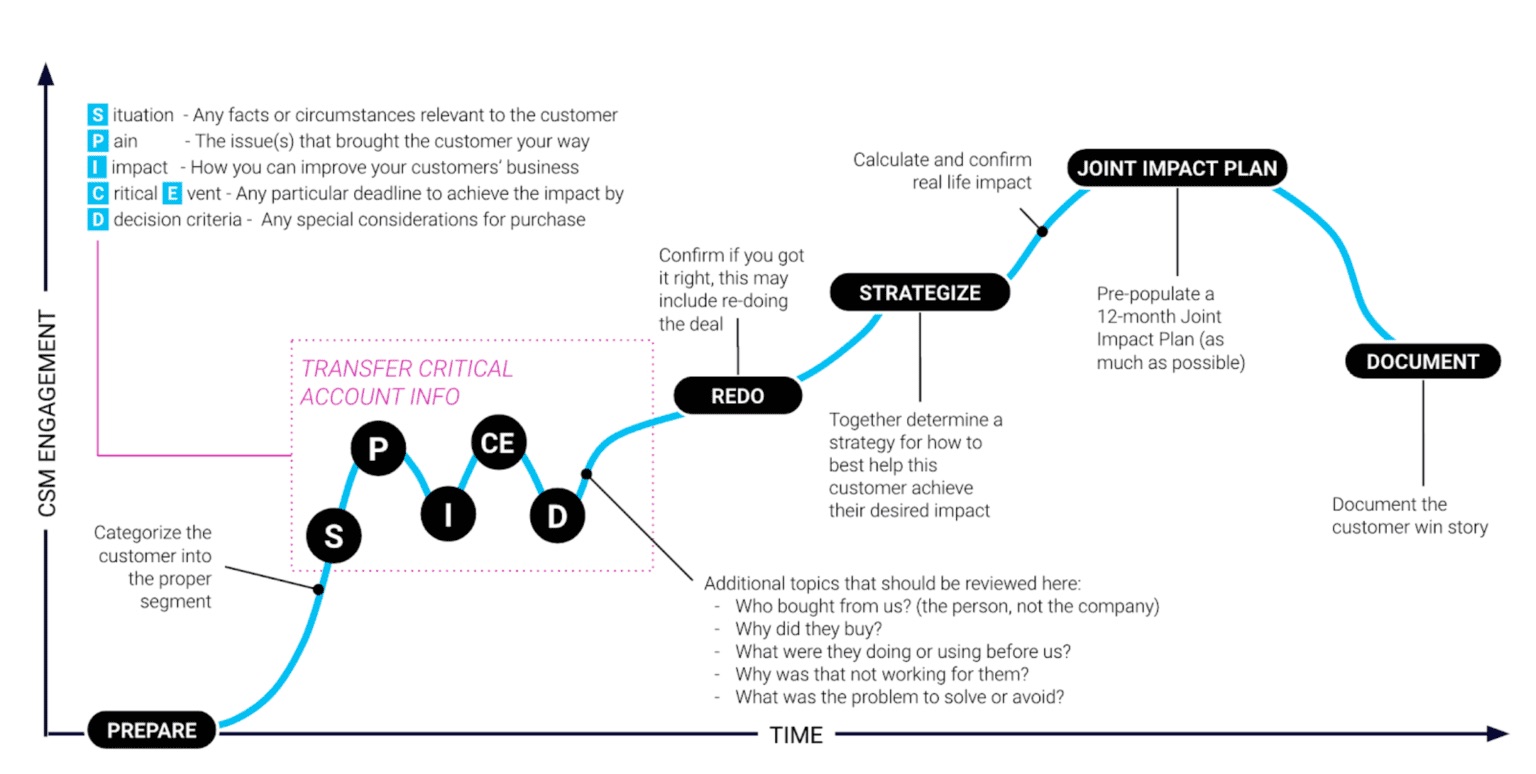

Applying SPICED to Customer Success

The SPICED framework can be used across all stages of the sales process. For instance, during the handoff of an account from Sales to Customer Success, a strong focus (see ‘TRANSFER CRITICAL ACCOUNT INFO’ below) must be placed on reestablishing the impact that the customer is looking for (Figure 4).

Figure 4. The use of SPICED in the hand-off between Sales and Customer Success

References

Ref. 1. 2018 Expansion SaaS Benchmark (slide 30) – By K. Poyar and S. Fanning of Openview Advisors

Ref. 2. The SaaS Sales Method: Sales as a Science, by Jacco J. van der Kooij, via Amazon

Ref. 3. Seven Sales Qualification Methodologies by Jeremy Donovan via Slideshare

Ref. 4. Solution Selling Definition and Research by Nadia Landman via blogpost on web-site

Ref. 5. SPIN Selling by Neil Rackham via Amazon

Ref. 6. The Challenger Sales: Taking Control of the Customer Conversation by Matthew Dixon and Brent Adamson via Amazon

Ref. 7. MEDDIC Definition by SalesMeddic

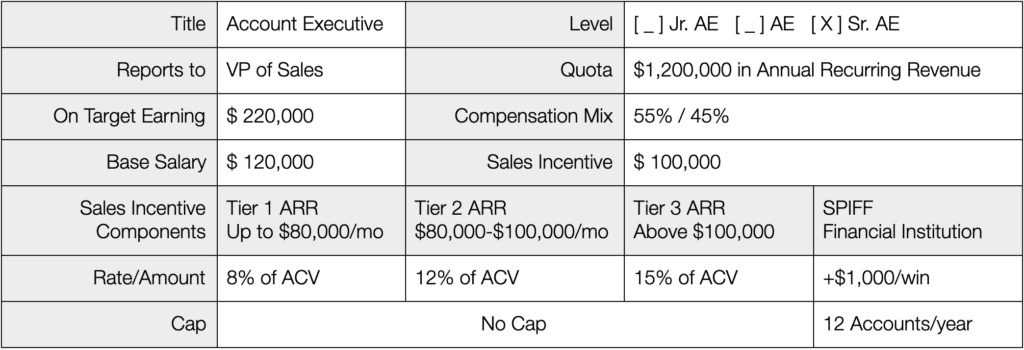

Every organization should determine the right compensation plan for each individual sales role upfront using a proven target-setting model and a multitude of other factors. Companies should consider how to structure base and variable pay and then set forth the responsibilities of the role and the terms of compensation clearly in a sales incentive plan.

Compensation in Sales Positions

The first step in providing fair compensation to each customer-facing role in your SaaS sales organization is the analysis of the following positions, duties, and experience required by each:

- Sales Development Rep (SDR): Prospecting. Positions may range from a first SDR job (Junior) who is focused on inbound sales to a Senior SDR with one to four years of experience who calls on key accounts (Account Development Rep).

- Account Executive (AE): Sales Acquisition, also known as a Sales Manager (SM). Positions may range from a first AE job (Junior) to an AE with three to five years of experience (AE), or four to eight years of experience (Senior).

- Customer Success Manager (CSM): Focused primarily on onboarding and enabling the client to use the product to create recurring value. Often with one to three years of experience.

- Account Manager: Focused on the company’s key accounts or driving new/more revenue from existing accounts. Often a former AE with three to five years of experience.

Step 1: Basic Guidelines

As a general rule, there are some basic, practical guidelines that you should follow as you plan and negotiate compensation with your sales organization team members:

- Keep it simple. Your compensation plan should fit on a single page of paper.

- Show causality. Make compensation directly related to the desired effect you wish for the team member to achieve.

- Think short-term. Keep the time between the activity and the compensation less than 60 days.

- Make it fair for everyone. All compensation must be fair and equal for everyone.

- Make it easy. Compensation should be easy to measure and easy to administer.

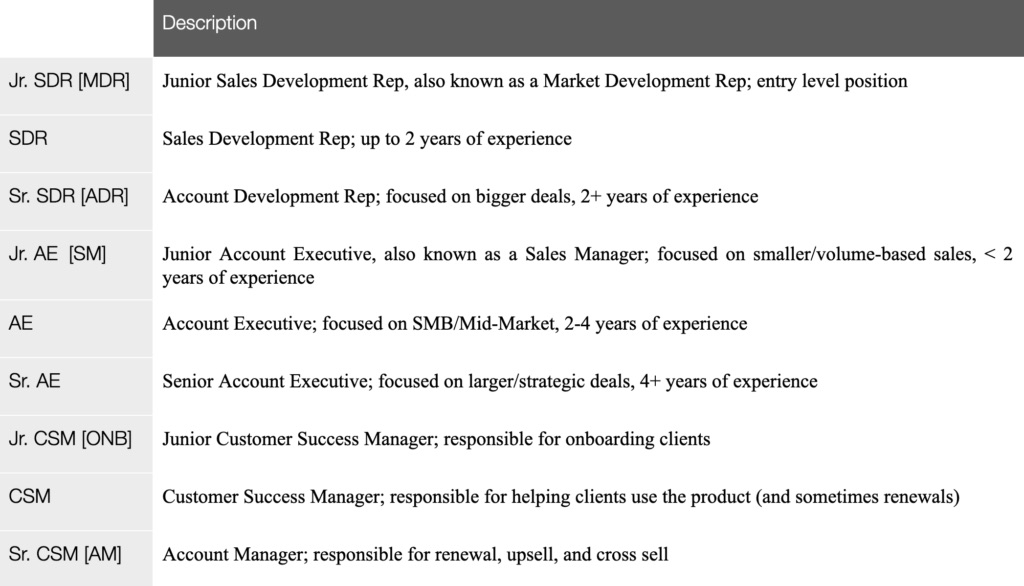

Step 2: Establish Levels of Experience

Begin by establishing three levels of roles within your organization: 1) Entry Level, 2) Baseline, and 3) Experienced/Top Performer. See Table 8.1 for descriptions of important sales roles and their accompanying levels of experience. There is an organizational need for three layers of experience in order to create a difference between an entry level position on one end of the spectrum and experienced on the other. Employees want to see progress early on in their careers, and these micro promotions answer that request and allow you both to make small adjustments accordingly.

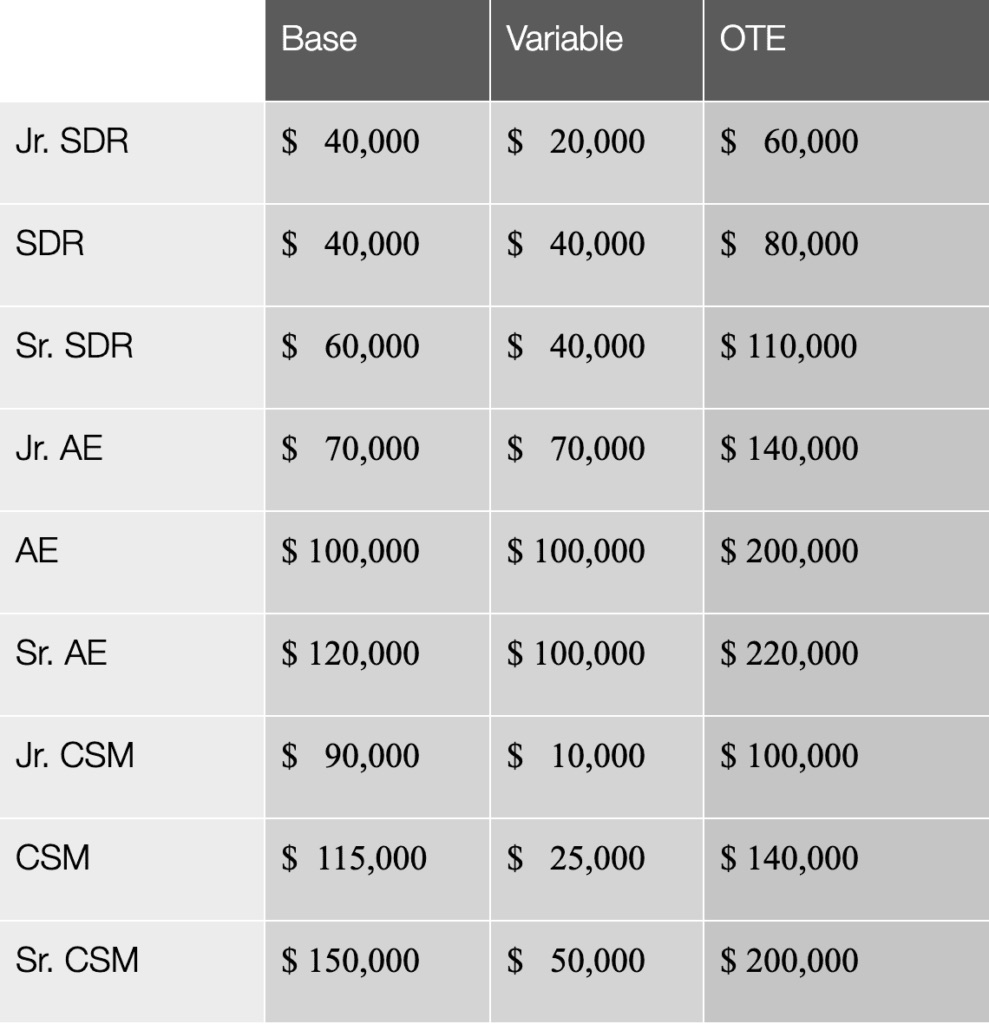

Table A. Overview of sales titles and job descriptions

Step 3: Start with On-Target Earnings

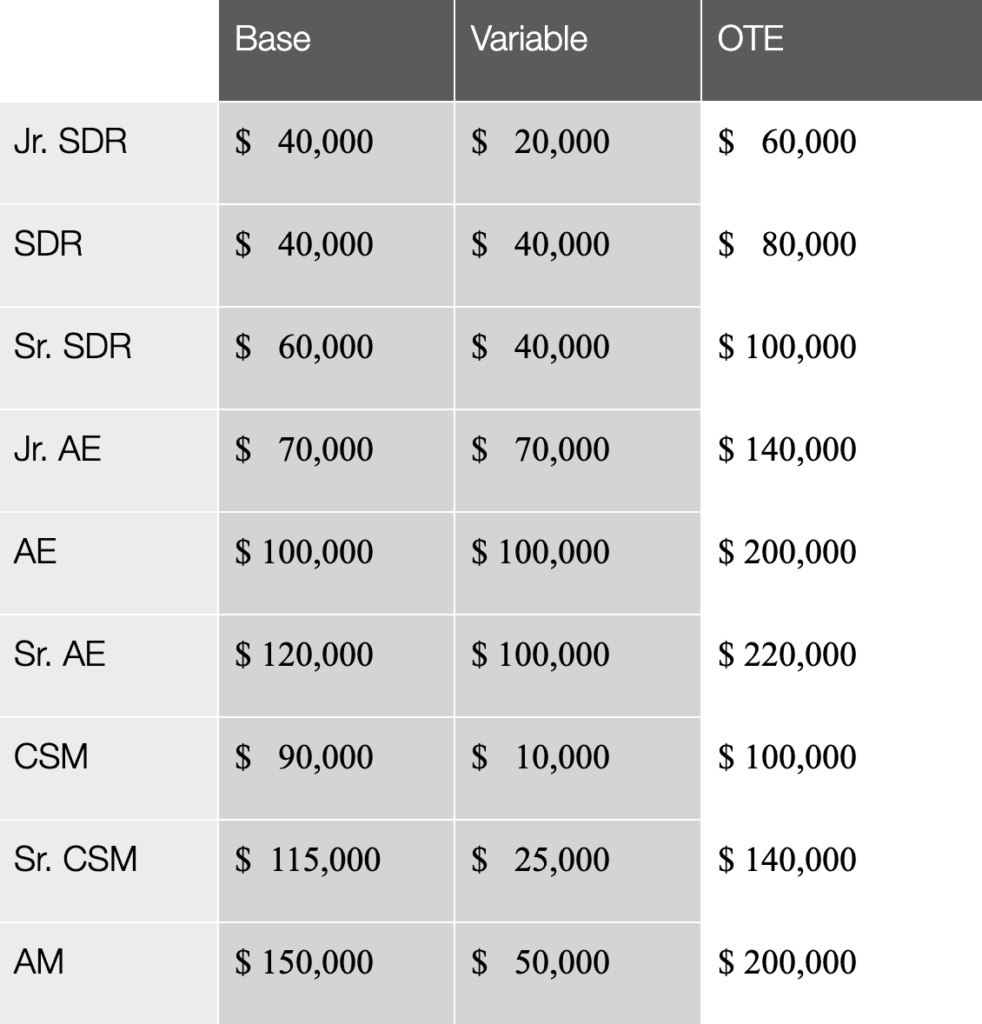

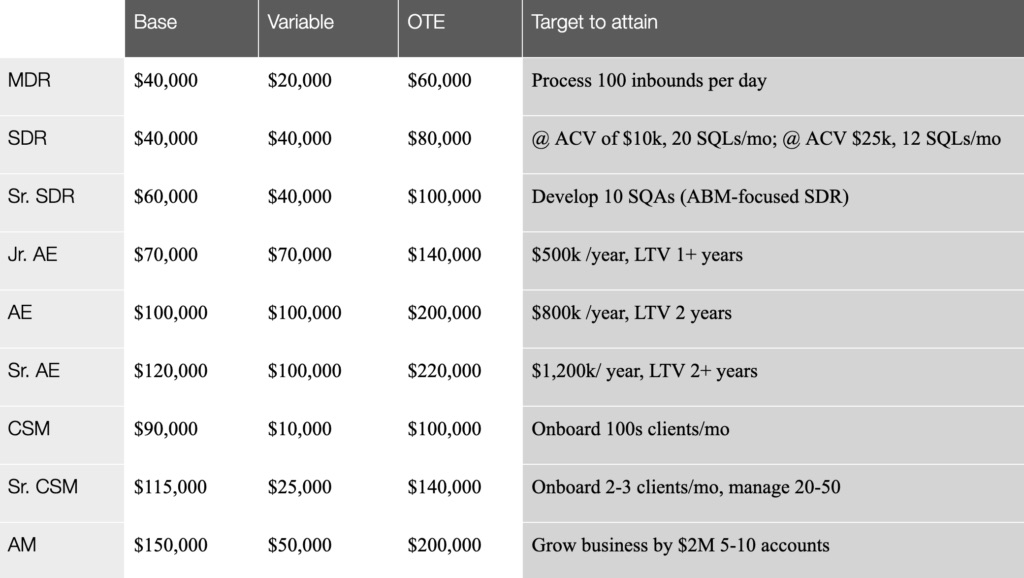

First, start with the On Target Earnings, or OTE, when determining compensation structure. OTE is the amount a person could be paid annually, and it has two elements: 1) a base salary, and 2) a sales incentive, also known as “variable” pay, which will be determined by employee performance. See Table 8.2 for a sample compensation table broken down by base salary, variable, and OTE.

Companies should refrain from calling any sales incentives a “bonus.” A bonus is not guaranteed and usually on-the-spot, whereas an incentive plan is forward-looking with payment tied to the achievement of specific objectives that have been predetermined, communicated to the employee, and noted in the incentive plan.

Table B. Overview of compensation in the Bay Area

Step 4: Determine Base vs. Variable

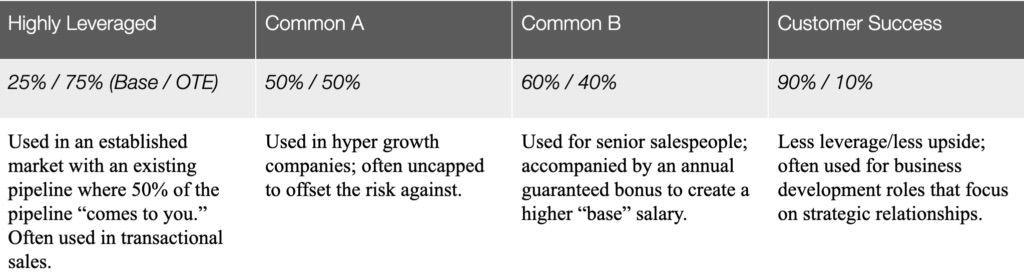

The goal behind the variable is to develop a performance-driven culture in which your sales team is financially accountable for its results. The ratio between the two types of pay is also referred to as “leverage.” A plan with a high variable alongside a low base salary is referred to as highly leveraged compensation plan.

A highly leveraged plan will mean that you only pay for results, however, this can create a lot of issues. For example, senior salespeople may not be interested in these positions as the banking system penalizes them when they apply for a mortgage, car loan, or any other request for credit. Highly leveraged plans are seen most frequently in transactional sales, where the volume is extremely high and prices are low. On the other hand, if the compensation plan has little leverage, your salespeople may be less motivated to deliver against set goals. See Table 8.3 for commonly used leverages and when they are used.

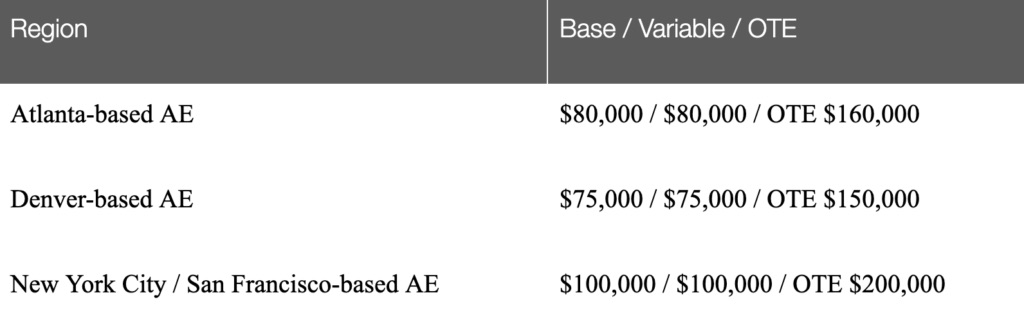

OTE can fluctuate per region, so it is highly recommended that you consult with a local recruiting firm to help determine your compensation structure before making an offer. See Table 8.4 for examples of OTE based on geographic region. Table 8.5 provides an overview of compensation packages for different sales roles in the Bay Area.

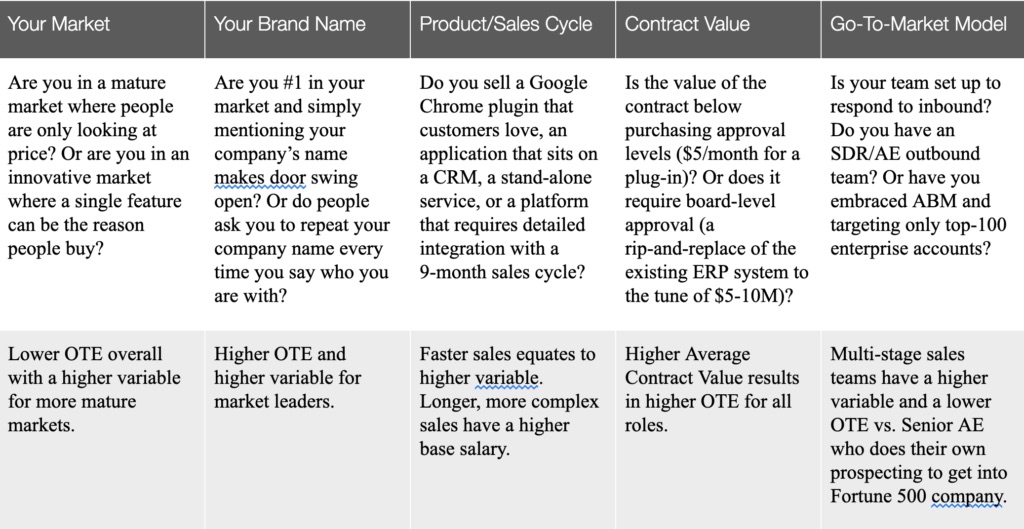

Several other variables will impact your company’s compensation plan as well, including your market, brand name, product, sales cycle, contract value, and go-to-market model. Table 8.6 breaks down each of these variables and how you should incorporate them into your compensation strategy.

Table C. Overview of commonly used leverages

Table D. AE salaries by region as of mid-2017

Table E. Overview of compensation packages in the Bay Area

Table F. Variables impacting compensation plans

Step 5: Target Setting

There are three models of target setting that can help you determine appropriate compensation plans, each with its own pros and cons. In this instance, consider a platform product with an Average Contract Value (ACV) of $25k:

Top-Down Target Setting: Start with the amount of revenue you wish to generate (for example, $4M in ARR). Divide this by the number of salespeople you have or wish to have (for example, 4) so you can determine how much revenue that equals per salesperson. In this case, $1M ARR per salesperson. You then divide that number by the ACV per deal ($25k), which is equivalent to 40 deals won per year (or slightly more than 3 deals per month). The problem with this older B2B approach is its lack of predictability. If something goes wrong, it will be difficult to measure where and when it occurred.

Bottom-Up Target Setting: Use 80% of your best month to date as your guideline. For example, the founder over the past year was able to close $800k in business at an ACV of $25k. When hiring a salesperson, therefore, the target will be set for $640k. To hit the same $4M target, you will need ~6 sales people. The problem with this model is that founder-based sales are not scalable, and it does not take into account support or dependencies. For instance, what if you need 4 SDRs to achieve this target but 2 CSMs to bring on the client? Your company would be operating at a loss. This is a common situation in today’s sales organization as the cost of acquiring a client has increased dramatically.

Business-Case Target Setting (Recommended): In this example, a sales acquisition team that sells a CRM platform uses one SDR ($80k), one Junior AE ($160k), and one-half a CSM ($120k divided by two) to prospect, win, and onboard 20 deals per month at $25k each. This means that it costs a total of $300k. Therefore, to make a profit, this team needs to bring in at least $300k, though it is generally recommended to bring in 2x that number, so the target should be $600k. It takes three months to ramp the team, and Year 1 and Year 2 are as follows:

-

- Year 1: $600k / $25k = 24 deals (take into account a 3-month ramp)

- Year 2: $900k / $30k = 30 deals

You will also want to consider the significant impact of Lifetime Value. For example, in the FedTech space, SaaS contracts can be established with three years of commitment. This allows for a richer compensation plan compared to a company with a nine-month client LTV (AdTech, for instance). When selling new products for which LTV has not yet been established, companies should not spend more than 40% of Year 1 revenues on the aggregate cost of OTE for SDR, AE, and CSM roles. For LTVs of 2+ years, companies should not spend more than 60% of Year 1 revenues.

Table G. An overview of targets by role

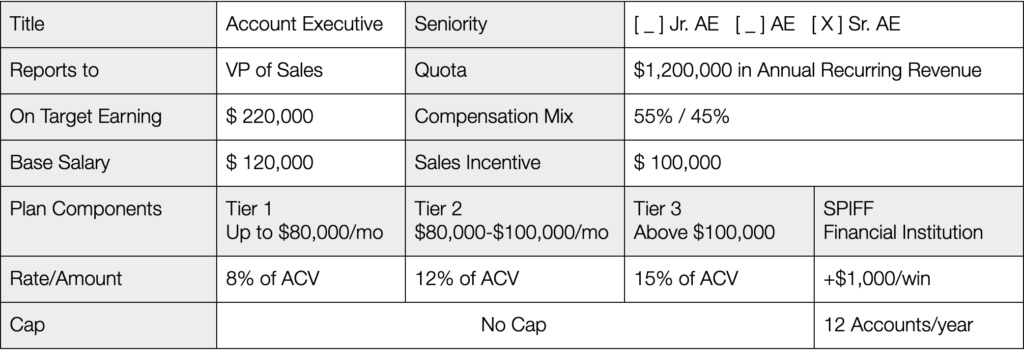

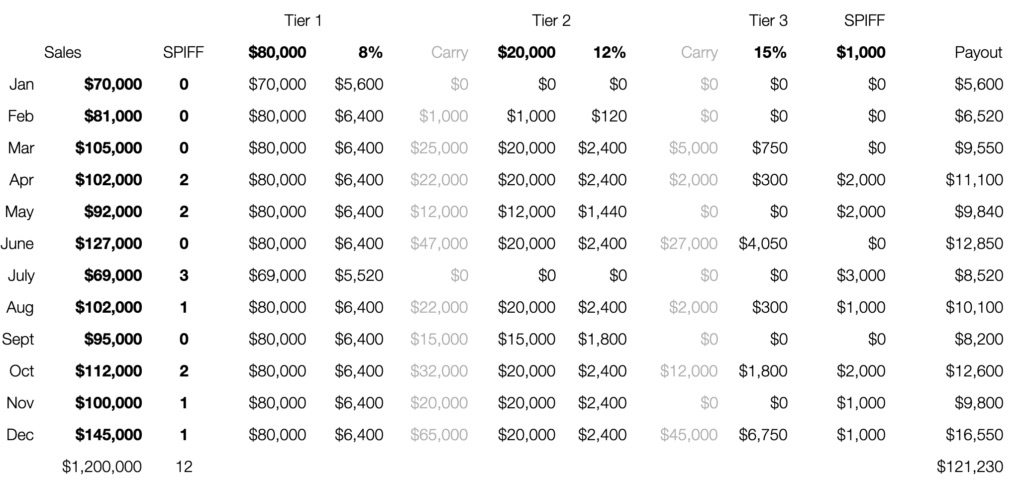

Step 6: Account Executive Compensation

To apply each of these compensation models when hiring a AE, consider the following assumptions:

$80,000 in variable compensation needs to bring in $900,000 across ~30 deals with an ACV of $30,000.

|

Junior AE Assumptions:

|

Linear Model: $900,000 in 30 deals vs. $80,000 in compensation = 8.8% of every sale every month. This is good for business at the speed of 2-3 deals per month using a two-stage (SDR/AE) sales organization.

Accelerated Model: This model will drive behavior to close more deals towards the end of the season with results as follows:

- 6.4% on first $500,000 ($32,000 in commission)

- 12% on $500,000 – 900,000 ($48,000 in commission)

- 15% over $900,000 (upside)

- Remember that this model also requires matching of the commission season to the buying behavior of your customer. For example, schools/districts buy from March to July, federal government from August to October, enterprise clients from November to December, and retail from March to July.

Business Model: Depending on the results that your company seeks, these sample compensation structures are effective in the following areas:

- Size of Deal – Very effective in driving a team to sell more items to increase the price: 5% on deals less than $20,000k, 10% on deals greater than $20,000, and 15% on deals over $30,000

- Market – Very effective to open up new markets: 7% to schools in California and 10% to schools in Colorado

- Product – Very effective to drive sales of new products: 5% on standard platform, 8% on add-on services, and 15% on new platform services

Table H. Example compensation plan for an AE

Table I. Example payout of AE using Accelerated Model and Business Model

Step 7: Compensation During Onboarding/Training

For professionals who already earn $10,000 a month in commission, it might be difficult to digest the idea of foregoing that type of money for three months when they first start working at your company and require training or onboarding. As such, it is normal for these candidates to ask that you pay this amount during the training or onboarding period. To facilitate this process, you will typically use what is known as a “draw.”

Using the example above, consider a salesperson doing $80,000 of business per month. Divided by 12 months, that equals $6,667/month. Compensation options might include the following types of draws:

Draw: Commission paid upfront against the promise of performance. Think of this as a loan without interest.

Non-Recoverable Draw: You pay $6.67k per month. If they close $10,000 worth of commission, you pay $3,333 extra. See Table 8.11 for ideas on how to make new hires “earn” the non-recoverable draw.

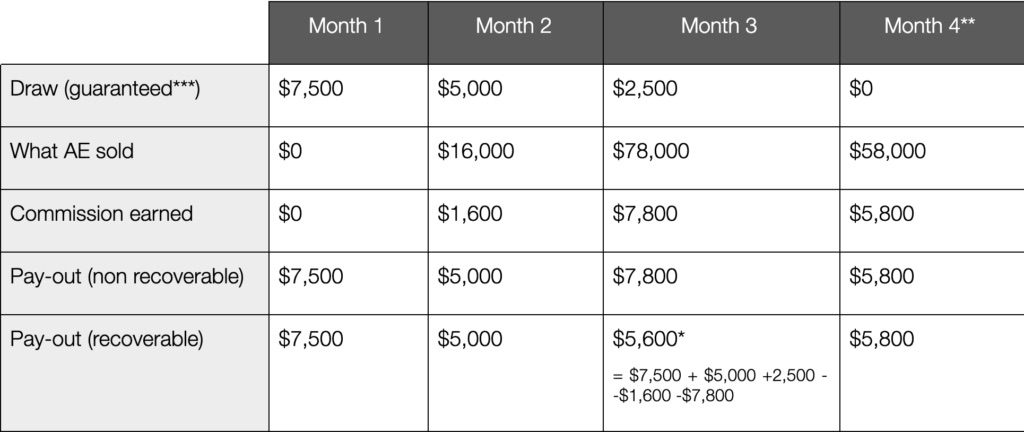

Recoverable Draw: You pay $6,667 per month upfront. If they only close $5,000 worth of commission, the amount of $1,667 rolls over to the next month. See Table 8.10 for more examples of recoverable versus non-recoverable draws.

Clawback: In the above example, the salesperson would have to pay back the company $1,667. Clawbacks can be used against draws but also against deals on which commission was paid if the client churned following less than three months of use. (This is often the result of selling to the wrong customer.) It is not common to claw back commission if the client churns after more than 3 months of use. (By this point, it is deemed the responsibility of the CSM team.)

Bookings vs. Cash Collections: This is a touchy subject as business in most rapid growth companies is risky. A booked client does not guarantee cash collection. Consider the following baseline ideas when deciding whether to structure compensation against bookings or cash collection:

- Compensation against bookings accelerates deals and is best used during growth. Compensation on cash collections improves the quality of deals and is commonly used during maturity.

- Early stage companies do not want to hand out money, but compensating on cash payments will not make this easier. In particular, it may result in the following downsides:

- Delayed incentives result in lack of causality

- Difficulty motivating a team on cash goals ~45 days after the deal closed

- It may signal to top talent to ignore your company as something must be wrong (high churn rates, etc.)

- There are easier ways to ensure that you only pay against companies/deals that paid:

- Claw back the next month any deals that fell through the previous month.

- Adjust quota to accommodate for premature churn.

Onboarding/Training: For companies with a sales cycle up to 90 days, 90 days is the most common onboarding time. If you sell a complex security solution and you have no prior experience, however, onboarding can easily take six to nine months. On the other end, if you are selling a Google plug-in, you may only need a few days to onboard.

As an example of a draw, consider a linear model for a compensation plan of 10% of sales based on a $900,000 revenue target with a 90-day ramp versus a variable compensation of $90,000/year or $6,667 per month.

Table J. Impact of recoverable vs. non-recoverable draw

*If it does not exceed the guaranteed draw ($2,500), the draw prevails and it rolls into month 4.

**In sales speak, this is often referred to using the bowling term “the bumpers are coming off.”

***Any sales professional in a startup role will request a non-recoverable draw. This is valid because they are not aware of the risks they face, and in a hyper growth new role, there is plenty of risk. Compare this to a more traditional sales role in which the person takes over an existing/developed territory that brings in 80% of goal due to brand name recognition.

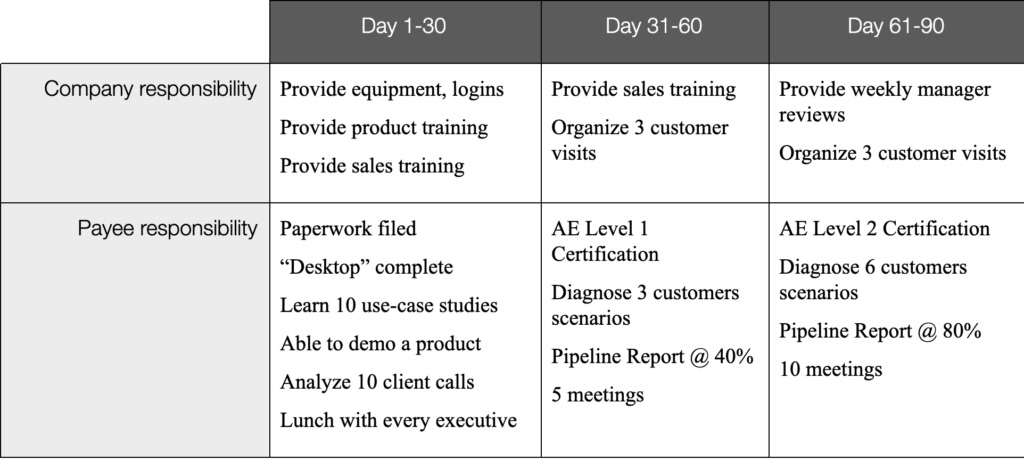

Table K. 90-day onboarding program to make new employees “earn” the non-recoverable draw

Step 8: Sales Development Rep Compensation

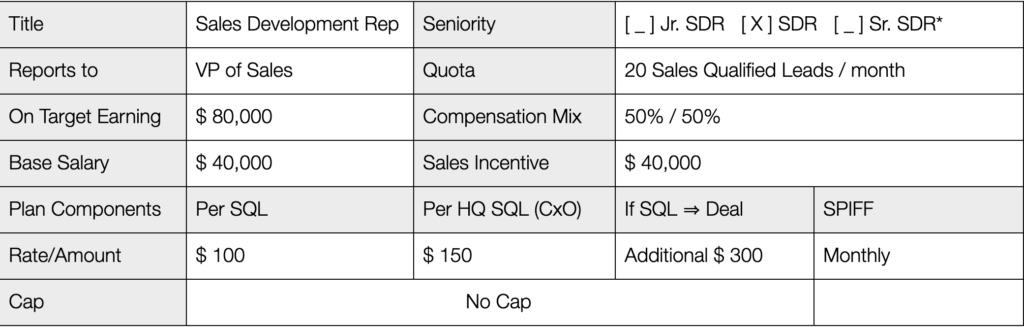

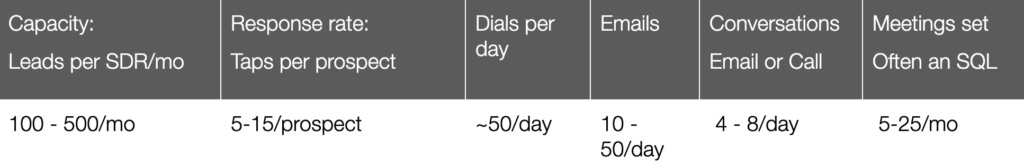

To apply each of these compensation models when hiring a SDR, consider the following assumptions:

$40,000 in variable compensation needs to bring in enough deals to win 30 deals per year.

|

SDR Assumptions:

deals with an ACV of $30,000

|

Linear Model: In this case, the SDR is closing 30 deals per year with a 1:5 win rate (this is the norm in SaaS sales vs. 1:3 in perpetual sales) which equates to 150 leads per year. $40,000 divided by those 150 leads equals $267/SQL, or rather $250/SQL. As the SDR generates 12 SQLs per month, that will equal $3,000 in commission. This also means that for every deal won at an ACV of ~$30,000 at a 1:5 win ratio, you will have to pay for 5 SQLs, which will cost your company $1,250.

In comparison, it is common to pay an external firm $500 for every meeting generated and $1,000 for every meeting set with a decision-maker. A referral fee of 5% ($1,500) is also common for an introduction at the manager/VP level or 10% ($3,000) at the CxO/Board level.

Accelerated Model: You can use this model to drive behavior toward qualifying the right deals. Plan to spend $1,250 for 5 SQLs since this is what the business model states above, but pay less per SQL. For example, $150 instead of $250 each. That means you will pay $750 total for 5 SQLs @ $150 each, which leaves you with $500 remaining, so you can now pay out $500 for every deal closed. In this case, you end up paying the same amount but drive behavior to identify quality SQLs.

Business Model: To drive behavior toward the opening of a new market, offer $150 for a medical company but $250 for a financial institution. To drive your team to reach seniority, offer $100 for a meeting with a manager and $150 for a meeting with a CxO/VP title.

Importantly, the definition of SQL and SAL needs to be clearly defined in either the compensation plan or printed on a poster on the wall of your company where it is clearly visible for all team members to see. Be sure to give examples to your team of what constitutes an SQL, but also remember to give them examples of what does not constitute an SQL.

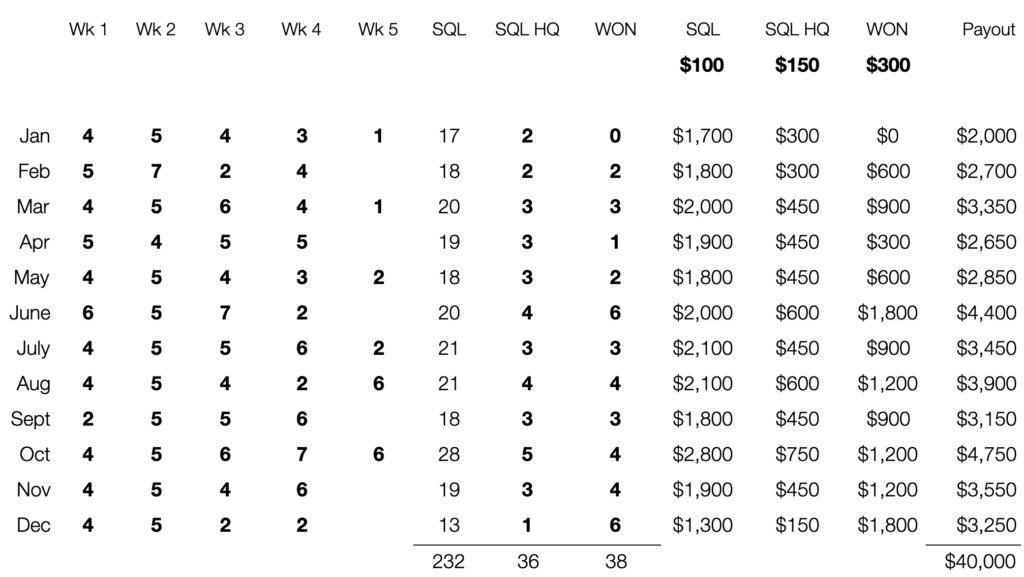

Table L. Example compensation plan for SDR

*A junior SDR is often the same as a Marketing Development Rep calling on inbound leads only, whereas the senior SDR is often the same as an Account Development Rep calling on fewer targeted accounts along an ABM campaign.

Table M. Example compensation payout for SDR

Split Model: The SDR role is often under pressure because their compensation plans are held accountable against market metrics that frequently reset themselves. Whereas a few years ago, generating 30 to 40 SQLs per SDR per month was quite feasible, today the figures are closer to 10 to 15 SQLs per SDR per month, though this fluctuates with different markets, regions, etc. Due to the lower SQL count, you may follow the model and conclude that you need to compensate your SDR $500 or even $1,000 per SQL, however, such a high value per SQL invites the SDR to take advantage of the model. In such cases, you should split the model by reducing the price per SQL to $200-250, and then adding compensation for productivity in the form of number of emails, calls, event sign-ups, visits to trade show booths, etc.

Table N. Metrics to consider in SDR compensation plan

Quality vs. Quantity: To generate volume, you can compensate based on SQLs for meetings set. This, however, may lead to an influx of unqualified deals. To set a standard for performance, the AE can accept the lead, turning it into a Sales Accepted Lead (SAL), which offers you three options to guarantee quality:

- Compensate on SQLs, but lower the price per SQL from $100 to $50. Note that you are wasting AE resources if they have a lot of unqualified calls.

- Compensate on SALs instead of SQLs. This reduces the velocity, but creates a strenuous relationship between the SDR and AE, as the AE may disqualify deals that SDR worked hard on.

- Add a Quality Measure. Shift the gravity of the compensation within the compensation plan. For instance, $50 per SQL + $500 per deal won.

- Claw back commission at the end of the month by taking out all deals that did not turn into an opportunity.

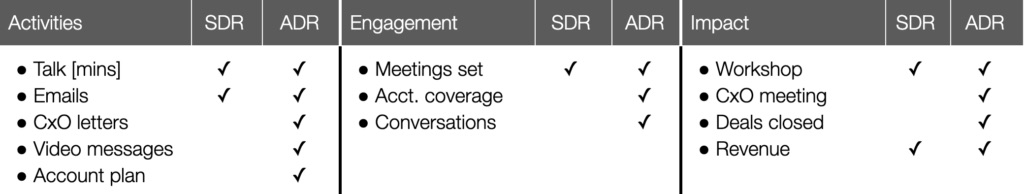

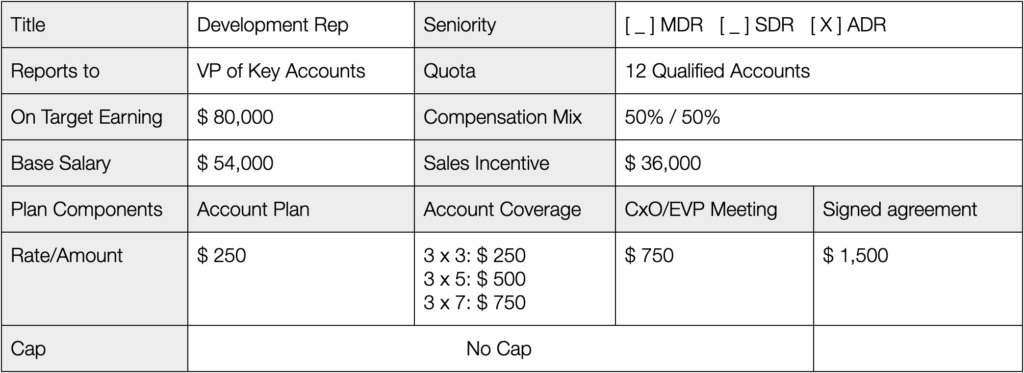

Account Development Rep Compensation

Account Development Reps (ADR) are different from SDRs in that ADRs focus on key accounts or targeted accounts. They are often responsible for implementing Account-Based Marketing (ABM) campaigns as well. The compensation of an ADR is different because it is focused on a fraction of the accounts. This role has three key elements – Activities, Engagement, and Impact – which can be distinguished from the roles of an SDR, as displayed in Table 8.15.

If you have a group of Development Reps, you may have to combine a variety of these tasks across roles and across time. For example, a major annual event such as an industry trade show may influence the way you compensate each role.

Table O. Differences between SDR (outbound) and ADR (targeted accounts) compensation plan

Typically, a rapidly growing firm will compensate SDRs as follows:

- Outbound Target: By Sales Accepted Leads (SAL) created by outbound campaigns (1 to a few). Generation of these SALs are based on call volume MBO (management by objectives).

- Account-Based Marketing Target: By Sales Accepted Opportunities (SAO) created by ABM campaigns (targeted accounts). SAOs are tied to setting up calls/meetings with people within these accounts.

- Event Target: By meetings set at events. For example, for large events such as Dreamforce, a quota is added for meetings, e.g. “Book 10 meetings a day at Dreamforce.

Table P. Example Compensation Plan for ADR

Step 9: Items to Include in Sales Incentive Plan

The Sales Incentive Plan that you agree to with your employee should include or specify all of the following terms, tailored appropriately to your business needs:

Monthly vs. Quarterly Payments: Evidence clearly shows that monthly payments reduce “the hockey stick effect” or the scenario in which 50% of all sales come in the last two weeks of the quarter. There are very few exceptions to this rule.

Payment: With 50% of compensation based on commission, you must pay compensation on time with the same due diligence as any other salary compensation. The industry norm is one payment cycle after the quarter closes (e.g. within 30 days of the month’s close).

Capping: If capped at $400,000 annually, this means that even if total compensation exceeds $400,000, the team member will not get paid above $400,000. This is a common practice for companies in which strategic deals have a large team working on them. For example, a Fortune 500 company may choose to deploy an enterprise-wide solution following a series of meetings at your CEO/VP’s office that the AE was not part of. In this case, the AE should be notified that capping may apply.

Override: To overcome unknown scenarios, all compensation plans should contain an override by the CxO/VP. For example, if a sales team falls $400k short on quota, the CEO may work with a board member to have a portfolio company “buy” the product/solution in order to overcome the shortfall. This is a situation in which the override authority might be enforced.

Fair Compensation: Sales has been an alpha-centric job for decades, therefore, sales compensation receives a lot of scrutiny with regards to equality in gender, age, race, etc. At the same time, it is common practice for a VP of sales to bring in a former sales performer or individual contributor at an increased pay rate since they are a known entity. As another performer is let go to make room for the “top performer” (or due to his or her underperformance), there may be grounds for a lawsuit. Regardless of the performance of the former contributor, if he or she was not fairly compensated during his/her tenure, there will likely be grounds for a lawsuit.

Fair Compensation Board: It is strongly recommended that portfolio companies with more than 25 people establish a Fair Compensation Board which contains the CEO, an internal executive, an industry expert (often a board member), and an external HR professional who agree to quarterly review compensation and ensure fairness. This not only protects against hiring people at overly large compensation rates, it also allows underrated top performers to get noticed and put on an accelerated career path.

Step 10: Draft a Two-Page Contract with Mutual Commitment

The following page contains a sample Sales Incentive Plan that may be used as a template with new hires:

Sales Incentive Plan

Revision Date: June 23, 2017

This document describes the agreement between ______________ (“Company”) and ______________ (“Payee”) regarding terms related to sales incentive compensation. Company and Payee enter into this agreement whereby Payee provides services to the Company in return for compensation specified in this agreement.

Table 1. Overview of the Payee Compensation Plan

All commissions will be calculated and paid once every month, for the preceding month. Commissions will be calculated and paid out as part of the next payroll cycle, following the month for which commissions are calculated.

Base Salary Payout – Sales Rep is due a base salary of __________, payable every __________.

Sales Incentive Payout – Sales incentive compensation is payable every __________.

Expenses – The Account Executive will be paid for all travel and lodging expenses related to sales activities within 30 days of being presented with the receipts and a completed and accepted expense reimbursement form.

Travel and Lodging:

Auto Travel Reimbursed at the current federal reimbursement rate

Cell Phone Sales Reps will be required to maintain a cell phone as part of conducting sales business. Sales Rep will be provided an allowance of $50 per month for cell phone usage.

Client entertainment expenses will be reimbursed as follows:

Meals/Coffee Reimbursable with receipts

Special Events Must be pre-approved. Reimbursable with receipts

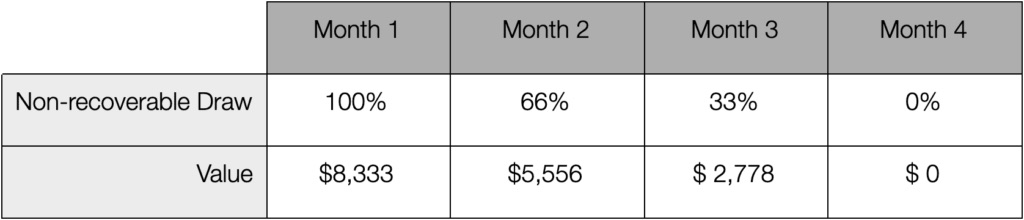

Draw – Payee receives a monthly non-recoverable draw against the sales incentive plan as follows based on the participation and completion of the 90-Day Onboarding Program.

Table 2. Eligible Draw Month-over-Month

Clawback – In order to receive your full commission with no clawback, the customer must stay live for 3 months from the day we start billing the customer. If a customer cancels short of the 3-month mark you will have a prorated amount clawed back from your commission against the sales made.

Draw Clawback – If Payee voluntarily leaves the position within the first 6 months of this plan, the Draw payment(s) will be due back to the Company through a payroll deduction from any monies owed to Payee.

Splits – Commissions can be split with other Payees, on a deal-by-deal basis at the discretion of the VP of Sales.

Termination of Employment – On voluntary or involuntary termination of Payee’s employment with the Company, commissions will be paid on transactions dated prior to the termination date only. Any amounts owed to the Payee will be according to employment regulations after withholding taxes and other dues.

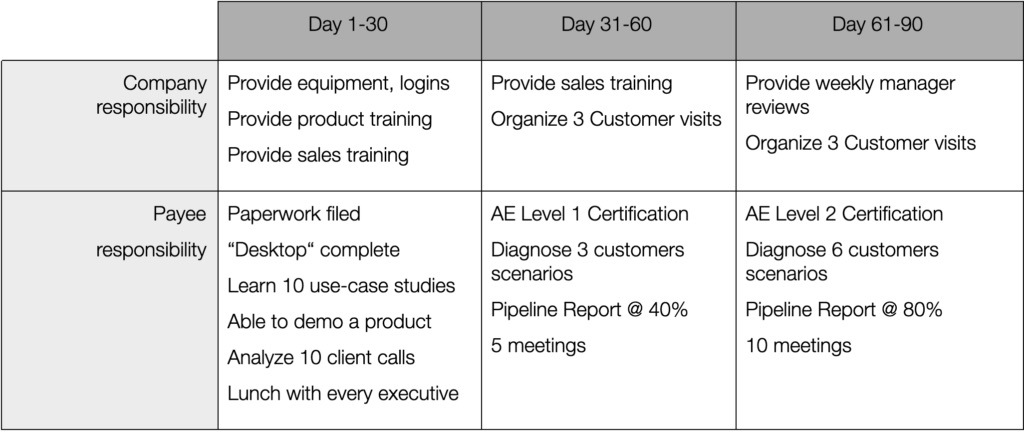

90-Day Onboarding Program – The onboarding program will take place over 90 days and the following activities are expected from the Payee to be eligible for the Draw as outlined in Table 2.

Table 3. 90-Day Onboarding Program

Other Important Terms

- Payee agrees to follow all federal and local laws while engaged in providing services to the Company during the period of this agreement.

- Payee shall not engage in any other employment during the term of this agreement. Company reserves the right to require Payee to terminate any such other employment at Company’s sole discretion.

- Payee shall use the most ethical practices while engaging in any sales activity.

- Payee agrees to protect all confidential material including prospect data, sales data, and client information belonging to the Company and shall take all reasonable care in making sure that such confidential material is not disbursed to anyone outside the company.

- This entire agreement shall be governed by the laws of the State of _______________.

- VP of Sales reserves the right to override the terms of this agreement without cause.

|

Company / VP of Sales

By: ________________________ Title: _______________________ Date: _______________________ |

Payee / Sales Rep By: ________________________ Title: _______________________ Date: _______________________ |