We recommend those who have invested in MEDDIC and have achieved adoption within the team to continue their investment. instead contemplate to integrate MEDDIC and SPICED. For the same reason you should not stop a marketing campaign, an email newsletter, or use of a CRM for that matter.

SPICED is a methodology that goes across the entire customer journey, and its focus is to integrate different methodologies so they speak the same language and are interoperable with each other.

SPICED used in Deal Qualification

One of the most commonly used methodologies in the sales process is MEDDIC. MEDDIC is the epitome of a departmental function, in that it is only applied in sales, and primarily used by sales professionals. It’s like the Lightsaber of the older generation. So, can we make MEDDIC interoperable with SPICED?

Applying MEDDIC to SaaS using SPICED

MEDDIC is a stage-based deal qualification methodology. It is particularly effective in complex sales environments where multiple stakeholders are involved. It emphasizes understanding the buyer’s needs, decision-making process, and key players within the organization. By addressing these critical aspects, sales teams can increase their chances of winning deals and minimize the risk of losing opportunities due to misunderstandings or misalignment. MEDDIC is an acronym that stands for:

(M) Metrics: Understanding the buyer’s specific metrics and Key Performance Indicators (KPIs) they must achieve.

(E) Economic Buyer: Identifying and engaging with the person with the authority to make purchasing decisions.

(D) Decision Criteria: Understanding the specific criteria the buyer will use to decide.

(D) Decision Process: Knowing the steps and timeline involved in the buyer’s decision-making process.

(I) Identify Pain: Uncovering the buyer’s challenges, problems, or pain points.

(C) Champion: Finding a champion or internal advocate within the buyer’s organization.

Whereas MEDDIC (and its derivatives) tells you where to pay attention, the SPICED approach’s framework reveals how to extract the information MEDDIC needs. What we are going to do next is demonstrate this by making MEDDIC interoperable with SPICED.

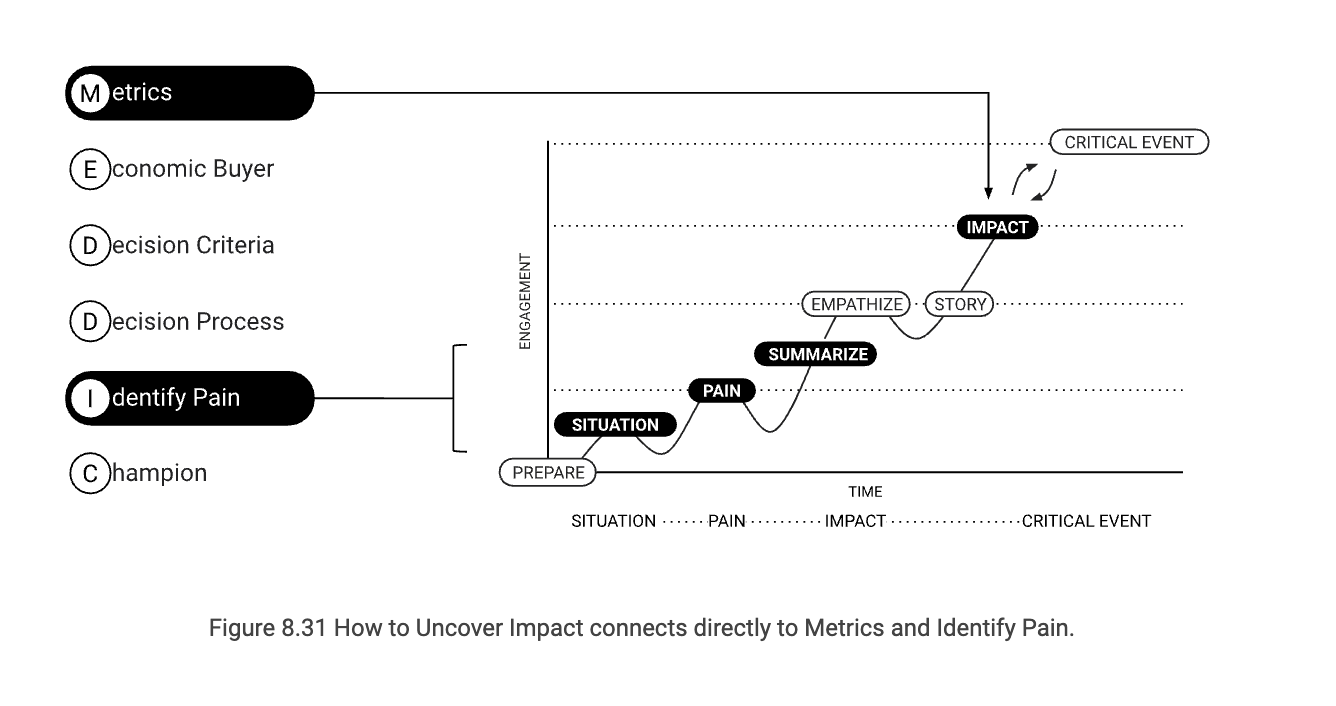

Step 1. Identify Pain and Metrics using the Impact Diagnosis Framework:

Identifying the metrics, as in the Impact your solution brings to the customer. The Impact-based framework 8.2.2 provides a 2-dimensional view of “How to Uncover Impact” and “Identify Pain.” It allows managers to leverage their investment in MEDDIC and expand that with a “and here is how you can” – from Knowledge to Know-how.

Whereas MEDDIC only looks for the rational impact, it shows you that through SPICED it also offers you emotional impact. It is amazing how robust MEDDIC still is 25 years after its conception.

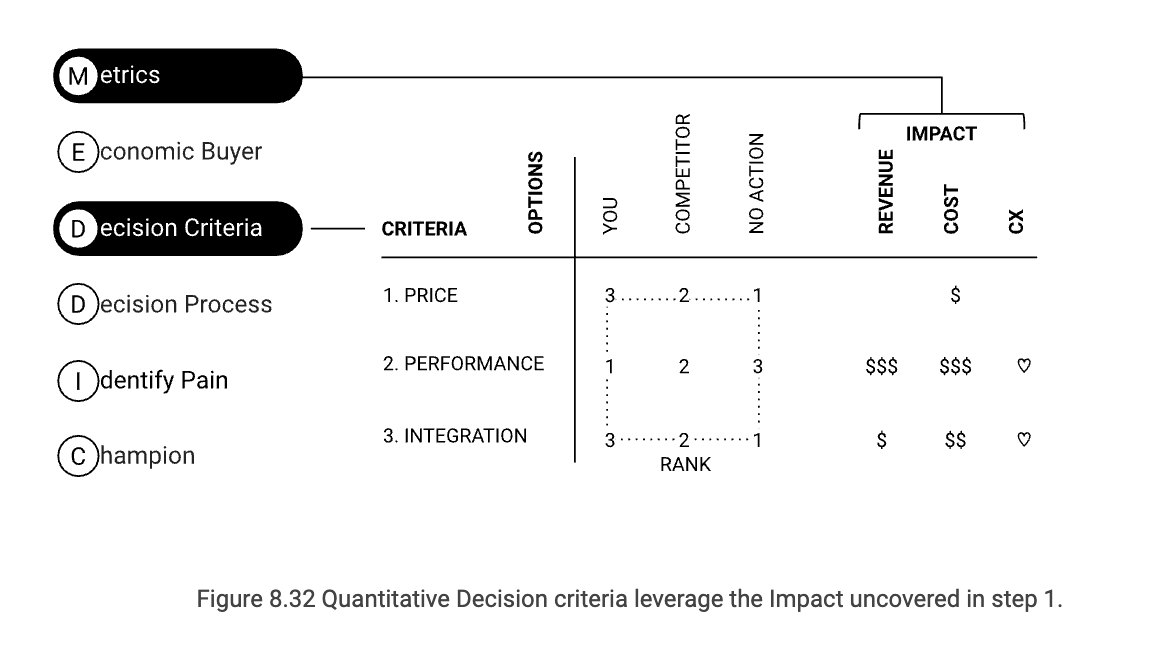

Step 2. Determine the Decision Criteria using Impact.

Once we have identified the Impact, we can make it part of the Decision Criteria, in which we help customers establish the rational Impact so they can communicate with their stakeholders using a quantitative approach.

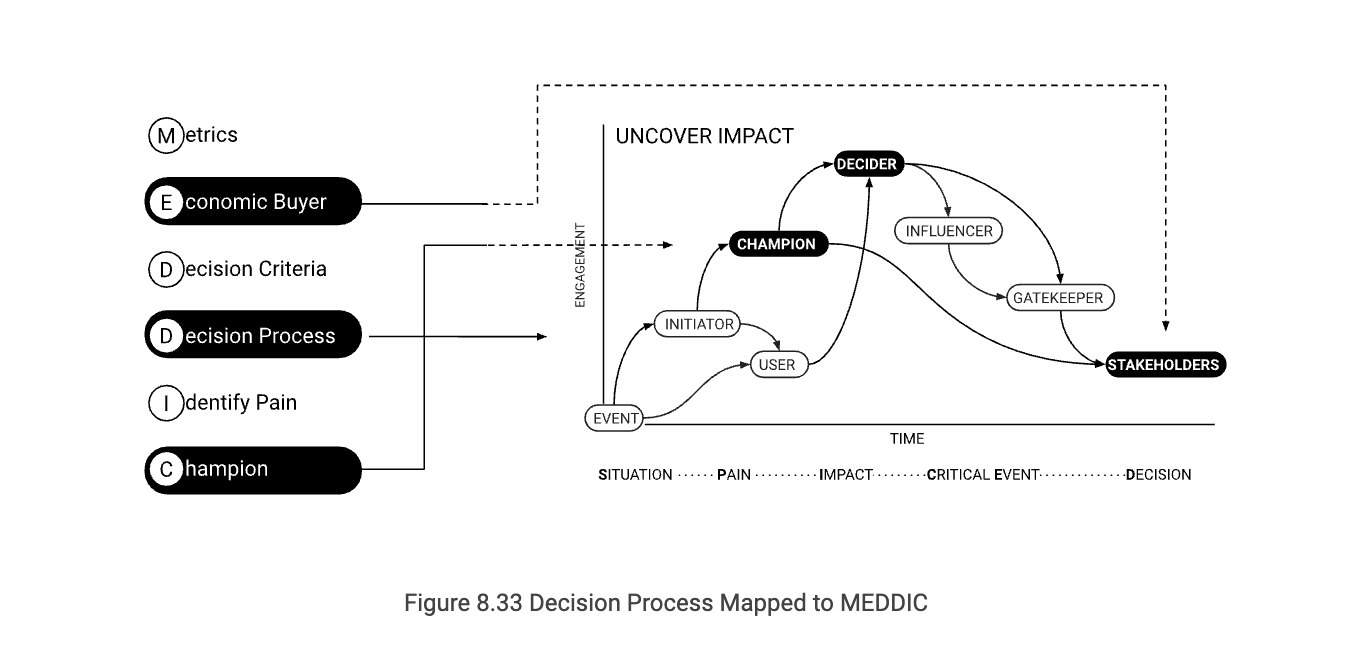

Step 3. Determine the Decision Process using SPICED

Historically, MEDDIC was used for perpetual software sales, priced in the millions of dollars, explaining the focus on getting consensus across a wide variety of decision-makers involved in the Decision process. Combining MEDDIC with the role of a buying center provides a roadmap that allows managers to tell what needs to happen and how to do it. For example, many sales managers have tasked their sales reps over time to “get to the decision-maker (decider).” With SPICED, we have learned that a champion is triggered by Impact and a decider by the date they need that Impact (Critical Event).

What is common across these three steps is that MEDDIC explains WHAT needs to happen, and SPICED; SPICED does this by connecting all elements of MEDDIC to IMPACT, creating a common connection between all elements of SPICED but, more importantly, building a bridge to marketing campaigns and customer success functions. SPICED gives an idea of HOW to make this happen and translates this to operational actions.

A comparison MEDDIC vs. SPICED

We get asked all the time what is the main difference between MEDDIC vs. SPICED, they are two very different approaches.

Comparison of SPICED and MEDDIC

| ASPECT | SPICED | MEDDIC |

| Origins | By WbD Established in 2012 for SaaS businesses. | Established in 1996 for Perpetual Software Sales. |

| Business Model | Subscription-based model. | Ownership-based model. |

| Metrics | Based on the full customer journey | Based on the sales funnel |

| Forecasting | Based on actions | Based on stages |

| Organization | Sales

Marketing Customer Success Product Management |

Sales |

| Sales Motions | Dedicated touch.(Strategic Accounts)

High-Touch (Enterprise) Mid-Touch (SMB) Low-Touch (Groups) No Touch (Pro-users) |

Dedicated touch.(Strategic Accounts)

High-Touch (Enterprise) |

| Target Audience | Seller with 5+ years of experience. | Seller with 20+ years of experience. |

| Action vs. Direction | Action Driven: Provides a how-to approach, giving actionable insights. | Direction Driven; tells you what needs to be done next. |

| Cross-Functional Communication | Uniform methodology for cross- departmental communication | Used to improve forecasting,

inter-departmental communication. |

| Integrated Sales Methodology | High velocity selling Provocative selling Consultative selling Solution selling Transactional |

Consultative selling |

| Supported roles in the Buyer Center | User

Initiator Champion Decider Gatekeeper Influencer Stakeholders |

Champion

Decider. |

| Primary Focus | Customer-centric

Focus on establishing impact. |

Seller-centric

Aimed at closing deals. |

| Focus Area | Centers on Priority, and RoI.. In SaaS every deal has a 10-100x RoI. |

Centers on RoI. |

| Set Theory Terms | SPICED has additional elements that cannot be found in MEDDIC. | All elements of MEDDIC can be found within the SPICED methodology. |

| Example | SPICED is used to target the right customer. During the sales process, it focuses on how to identify impact using question-based techniques and determines how this affects the decision criteria. It helps identify who is involved in the decision process. It can use a solution architect to help set a priority for the service against other SaaS purchases. Once a decision is made, it facilitates a seamless transition to the customer success team to pursue impact. | MEDDIC is used by the manager to check if a seller has performed an action. It relies on the seller to find a satisfactory answer, centered on RoI. It focuses on competitive advantages. It works closely with a sales engineer to provide a turn-key solution to the customer. |

Here’s a comparison between SPICED and MEDDIC, focusing on their efficacy in B2B software sales.

SPICED

Framework Components:

S: Situation: Current context where the prospect operates.

P: Pain: Problems or challenges faced by the prospect.

I: Impact: Emotional and rational consequences.

C: Critical Event: Time-sensitive triggers.

D: Decision: Decision-making process and criteria.

Methodology:

- Utilizes question-based selling during the discovery process.

- Incorporates storytelling where the “hero” is a person at the customer’s organization.

- Focuses strongly on both rational and emotional “Impact.”

Strengths in B2B Software Sales:

- Emotional storytelling and question-based selling make it highly adaptable and customer-centric.

- Capable of capturing a more holistic understanding of the customer.

- Well-suited for solutions where differentiation is crucial, even in crowded markets.

MEDDIC

Framework Components:

M: Metrics: Quantifiable economic benefits.

E: Economic Buyer: Person who controls the budget.

D: Decision Criteria: Standards for evaluating solutions.

D: Decision Process: Organizational procedure for buying.

I: Identify Pain: Business challenges needing resolution.

C: Champion: Advocate within the customer organization.

Methodology:

- More structured and metrics-driven.

- Typically does not integrate storytelling as a core component (though it could be adapted to include it).

Strengths in B2B Software Sales:

- Strong in environments where quantitative ROI is a primary concern.

- Ideal for complex sales involving multiple stakeholders.

- Often used in longer sales cycles and high-value deals.

Comparing the Two in B2B Software Sales:

- Depth of Understanding: SPICED’s question-based selling may provide a more comprehensive view of individual motivations. MEDDIC, on the other hand, excels at understanding organizational structures and metrics.

- Emotional Connection: SPICED explicitly focuses on emotional impact and incorporates it into storytelling, making it more engaging on a personal level. MEDDIC is more data-driven and may not explicitly account for emotional factors.

- Sales Cycle and Complexity: MEDDIC often shines in complex, long-cycle sales typical of large enterprise solutions. SPICED can be more agile and better suited for shorter cycles or less complex solutions.

- Decision-Making: Both frameworks address the decision-making process but from different angles. SPICED delves into emotional and rational impacts affecting the decision, while MEDDIC focuses on criteria and processes.

- Customer-Centric vs. Process-Centric: SPICED, with its storytelling and question-based methodology, can create a more customer-centric experience. MEDDIC tends to be more process-centric, focusing on the systematic progression of a sale through an organization.

The choice between SPICED and MEDDIC may depend on your specific sales environment, the complexity of your product, and the emotional vs. rational drivers you find most effective for engaging your prospects. Both frameworks have merits; understanding their distinct advantages can help you tailor your sales strategy accordingly.

Authors:

Jacco van der Kooij

Founder

Winning by Design

Pablo Dominguez

Operating Partner, Sales & Customer Success

Insight Partners

Summary

Underperformance is a critical issue plaguing SaaS companies, and its impact is more severe than many revenue leaders realize. The “Golden Age of SaaS” witnessed a period of overhiring as companies scrambled to meet the market demand for modern SaaS products. While it was easy for employees to succeed in a strong market, the cracks began to show when the market weakened. Currently, two out of three representatives are unable to meet their targets, putting organizations at risk. This overview outlines the causes of underperformance, why traditional solutions are ineffective, and how teams are using a modern sprint-based approach to address this pressing issue.

The Magnitude of the Underperformance Problem

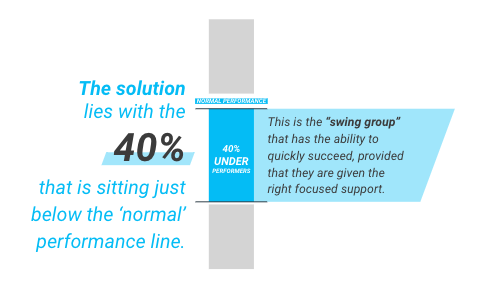

A staggering 68% of the Go-To-Market (GTM) team in SaaS companies is underperforming, with only 32% operating at a “normal” level (meaning, consistently hitting at least 80% of quota). Deepening the issue is the fact that the underperforming cohort delivers significantly less than the “normal” group, with the latter being 1.53 times more productive.

The impact of underperformance

Underperformance affects the entire GTM team, including sales, marketing, and customer success. Sales teams struggle to meet new business quotas, marketers fail to engage ideal customer profile (ICP) accounts effectively, and customer success teams fall short of their net revenue retention (NRR) goals. The composition of the team has also shifted in a significant way, with the percentage of high-performing representatives decreasing to a mere 4%, while the lowest-performing group has increased to 28%.

Why cutting costs alone doesn’t work

Layoffs happening all across SaaS – according to Layoffs.fyi, more than 200,000 layoffs have already taken place in 2023 as of the writing of this article, which already exceeds the total number of tech layoffs in 2022. This is a standard, and often necessary, strategy that leadership applies in order to ensure the viability of a company to get through tough times. And it’s effective for cutting costs, but what next? “These days, companies are good at cutting costs, but not nearly as good at driving productivity,” says Pablo Dominguez, Operating Partner for Sales and Customer Success at Insight Partners. “Once you downsize the team, the remaining team members need to be trained, and their skillsets need to be improved.”

Who your “new” buyer really is

On top of these market challenges, teams now have a “new” buyer. The CFO is far more involved today in purchases, even at lower value thresholds. According to CFO Magazine, 84% of CFOs said they expect to be more involved in developing technology strategy than they were in 2022, and more than a third of those are expected to be “significantly” more involved.

This means that GTM teams “must learn how to understand this new buyer who is taking a far more prominent role on the buying team than in the past,” says Pablo, and effectively address their concerns about budget, ROI of the investment, and alignment with corporate strategic imperatives. So once layoffs occur, the work has only just begun. For the GTM team that remains, the sales playbook and training needs to be adjusted in order to be effective in the market; those who fail to adjust will continue losing deals and seeing their revenue decline further.

Why traditional training programs aren’t working right now

Traditional strategies no longer suffice in the current market landscape. Let’s take a look at a few of these, and examine why they are not working:

- Large-scale training programs, while comprehensive, often fail to deliver immediate impact. These programs cover multiple skills within a single training course, resulting in reps lacking mastery in any specific area. Ongoing coaching and application of these skills are required, extending the time needed to see tangible results.

- Month-long onboarding bootcamps for new reps, which were previously popular, are no longer viable options. Many companies are currently reducing the size of their team, and don’t have the resources to dedicate to running extensive onboarding programs. Further, these programs typically do not measure results and ensure success of the reps before they “graduate” from the bootcamp.

- Rolling out a new methodology is another strategy that falls short in addressing the immediate underperformance challenge. While methodologies are essential for scaling sales teams, their successful implementation requires substantial change management efforts. As a result, they are unable to offer swift resolutions to the current urgent problem.

- Reliance on superstar reps have previously been a massive part of the revenue growth of many companies. But the data indicates a significant decline in the number of superstar reps across many companies. Sales leaders can no longer rely on a small group of high-performing individuals to carry them through difficult market conditions.

Given these limitations of prior solutions, a new approach is required to drive rapid and impactful change in underperforming SaaS companies.

Solving underperformance with Impact Sprints

To drive impactful change within 60-90 days, GTM teams require a solution that focuses on the 40% of underperforming representatives located just below the “normal” performance line. This group has the potential to succeed quickly if provided with the right support. The solution lies in implementing “impact sprints,” inspired by agile software development methodologies.

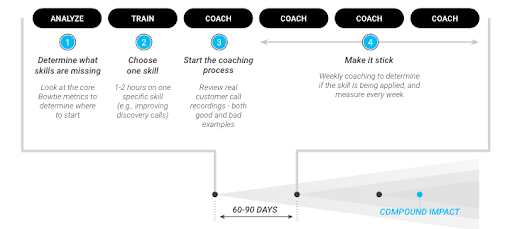

How to execute your own Impact Sprint

Analyze: Begin by analyzing the team’s key performance metrics to identify areas that require improvement for maximum impact. Whether it’s low net revenue retention or suboptimal contract values due to excessive discounting, select one metric that, when improved, will have a significant positive effect on the business.

Train: Once the skill gap is identified, provide training to employees focused exclusively on that skill. The keys to successful training include maintaining focus on a single skill, starting with simpler skills rather than complex ones, and keeping training sessions concise, lasting one to two hours.

Coach: Coaching is vital to ensuring the new skill becomes ingrained. Weekly repetition and reinforcement over four to six weeks are crucial. Frontline managers must be actively involved in coaching sessions to emphasize their importance. Using actual customer call recordings, demonstrate both successful and unsuccessful examples to facilitate learning moments for the team.

After implementing your first Impact Sprint, introduce subsequent sprints every 60-90 days. The goal is to establish a cadence of ongoing improvement, working towards clear and specific objectives. While the first sprint may not make a massive impact, the focus is on driving continuous improvement over time. By providing targeted support and maintaining a laser-like focus on impact, revenue leaders can elevate the performance of their underperforming employees.

Applying discipline to your continuous improvement effort

With traditional training methods not producing results in the current market, driving growth in SaaS companies requires a different, more targeted approach. Conducting layoffs in order to cut costs is a first step, but then you must increase the performance of the remaining team. SaaS leaders must identify and prioritize the skill gaps, and then execute to improve that skill with discipline.

Garry Kasparov, a chess grandmaster and longtime World Chess Champion, explains it as follows: “weak human + machine + superior process beats stronger humans and machines with inferior processes.” Or said another way, a strong process wins. Ensure that you have a strong process in place, that you can execute with discipline, for the entire team.

By adopting a disciplined sprint-based method outlined above, revenue leaders can prioritize and address one specific skill at a time, providing focused training and ongoing coaching. With diligent focus on skill improvement, revenue leaders can solve the underperformance problem and get back to driving enduring revenue growth.

Insight Partners has several resources available to help your teams:

- Close the skills gaps on your team by enrolling your reps in the appropriate role-based Insight Partners’ Revenue Academy courses, powered by Winning by Design.

- Contact your Insight Partners Account Manager if you would like help with running your own Impact Sprints