Why is it important for a recurring business to ?

Let’s say you are reaching the end of your runway, you need the next crucial hire or you have been offered a bad deal from a VC. There is a great saying I like to remind people of, which is “ makes most of your problems go away.”

Not just any though, because the days of “scale at any cost” are over. VCs today are looking deeper into the metrics of organizations, and they’re looking for unit economics and strong growth. They want to understand that growth is a priority for your , and that you are able grow at a steady rate and address the needs of your target .

Applying pressure to this situation is the fact that traditional channels are tightening. SEO and SEM channels are becoming more competitive in a lot of different markets, CPC rates are getting higher, and it’s becoming more expensive to go out and acquire customers to fuel those that VCs are looking for.

We’re also seeing a shift away from traditional SDRs (sales development reps) that go out into the field and acquire meetings or leads that are handed off to Account Executives. Even the 2.0 tactics, such as dedicating sales reps to sending outbound emails and calls to set up meetings, are becoming far less effective than they used to be.

It means that each needs to become a lot smarter with their approach to increasing and . They need to take a more systematic approach to , using a systematic .

Creating a systematic approach to growth for your SaaS business

There are four key metrics you need to measure and influence if you want to systematically grow sales for your . They are:

- Number of Opportunities. This is the number of active leads in your pipeline who are interested in purchasing your product.

- Average Contract Value (ACV). How much is each going to bring in for your business over the first year of the contract?

- Conversion Rates (CR%). As a percentage, how many of those leads turn into customers?

- Deal Velocity (In Days). This is also known as . How long does it take to get from a -generated lead to being a -generating

A quick hypothetical example of this scenario is that you may have 10 leads in your pipeline, with an average contract value of $10,000, a conversion rate of 35%, and of 30 days. So in this scenario, you would close deals worth $35,000 in annual within a 30-day period.

When you’re looking at these four metrics, there’s a lot of interdependencies that are important to notice. First, your ACV has a clear interdependency with your deal velocity. If you’ve got a million-dollar ACV, it’s not going to close in just 30 days.

There is also an interdependency between your ACV and the number of opportunities you have. Because, yet again, if you’ve got a million-dollar ACV, you are unlikely to have as many leads in the pipeline.

In short, each of the four factors play off each other. If you can influence one, it’s likely to influence another. But if you can shift the needle on all four at once, it can mean significant influence on these , and significant growth in a short period of time.

If you can shift the needle on all four key sales metrics at once it can mean a significant growth in sales in a short period of time.

Let’s break down each of them in more depth.

Number of Opportunities

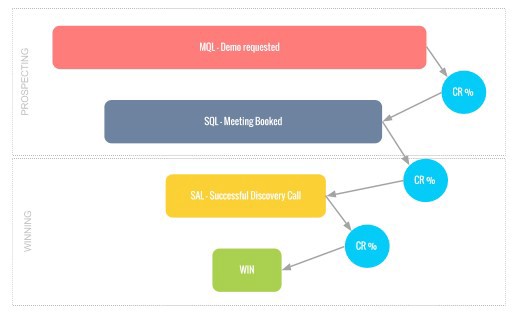

When you are looking to drive more opportunities, what you are essentially looking for is Sales Qualified Leads (SQLs).

There are two broad ways to drive more SQLs in a SaaS company, one is through sales and the other is through lead generation (marketing) activities.

Getting more opportunities from sales reps

From a sales perspective, SQLs are traditionally driven through a , or SDRs. Their sole purpose is to get a meeting with someone who is interested in learning more about the product, and who is in a position to influence a purchasing decision. Those meetings are what effectively label someone as an SQL.

The equation that a typical uses for growing SQLs through this channel is a feet-on-the-ground scenario: you hire more sales reps to get more leads. But you can also grow SQLs through sales reps by optimizing their activity.

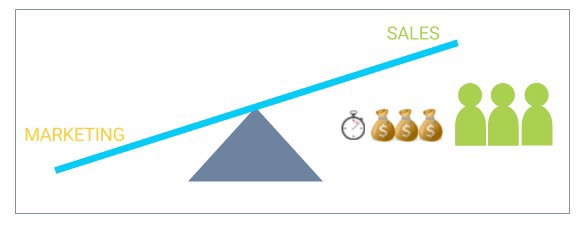

To get your sales reps on-boarded and productive can take about two or three months. So it’s quite quick, but it can be expensive. And you’ve got to be constantly testing what is working and what isn’t.

The beauty of acquiring SQLs through sales reps is that it is a very measurable and manageable driver of and growth. You can look at the activity metrics in terms of outbound emails, phone calls, and social touches that each of your reps are making. As you refine that sales process, you can accurately see the output that each rep is contributing to the business.

The beauty of acquiring SQLs through sales reps is that it is a super measurable and manageable driver of growth.

So if you can make that investment up front it becomes easily optimized over time.

Getting more opportunities from marketing

Moving onto the other side of the pendulum, let’s look at acquiring SQLs from .

Traditionally, what does is create what are called Qualified Leads, or MQLs. These are created through the mix of paid acquisition, , referrals, and brand awareness. To become an SQL, you nurture MQLs until they have enough interest that they are sales-ready.

Turning an MQL into an SQL requires a automation system; some common automation platforms for include Marketo, Pardot, and HubSpot. On top of the cost of the tools themselves, you then need to hire someone to manage them. Not to mention the cost of ads, creating content, and building funnels that help you get a steady flow of inbound MQLs into that system.

The cost of this setup is inevitably going to be cheaper than hiring those two to three sales reps, but it takes longer to generate results and .

The cost of acquiring leads through marketing is inevitably going to be cheaper than hiring sales reps, but it takes longer to generate results.

There are a number of factors that contribute to these results coming to fruition, such as the preferred channel of and demand in the market. And in reality, it could take 3 to 9 months before you start seeing a return.

The big challenge at the moment is that there is an abundance of available technology out there for funnel automation and personalized outbound communication. Which means that a LOT of emails are getting sent out, and people are becoming tired of these tactics. They’re less effective now. And the experts are telling us the same thing about the typical : most businesses lack a cohesive strategy to ensure their tactics actually accomplish their goals.

Your prospects can smell a templated email from a mile away. They know it’s fake, they know it’s not genuine. So instead of basic personalization, you need to focus on relevance. To be relevant requires a better understanding and segmentation of your group. If you can genuinely achieve this relevancy and connect with the actual pain points that your target customers have, then your team will be more successful in generating qualified leads for your .

Average Contract Value (ACV)

What you’ll find is that the Average Contract Value (ACV) is usually pegged to the organization’s best … or sometimes what the founder would like to charge for the product. It’s a lot to do with gut feel.

Especially when you’re talking about enterprise-level B2B sales, there is a lot of money being left on the table. People are really underselling their products.

When it comes to B2B SaaS sales, people are really underselling their products.

The ACV should really be based on the value that you’re providing the business.

How do you define the value?

A good rule of thumb is to take the 10x approach. That means, for example, if your delivers $100,000 worth of value to your — whether it is by decreasing costs, increasing , creating a better experience, or simply making life that much easier — then this rule states that you should be charging at least $10,000 for that product.

That 10x factor is there because it’s compelling enough to get your customers to sit up and take notice. It also covers the cost of making the organizational change required for switching across to a new product, which usually stands at about 3-5 times the cost.

But note that when you’re looking at this 10x approach, it can’t be done in isolation. You can’t simply come up with some fanciful ROI calculation that says you’re going to deliver $23 million worth of value over the lifetime of the relationship, hence you need to be charging your customers $2.3 million. That may indeed be the case, but you also need to take a realistic look at some other factors:

- What is the competition doing?

- What is the current cost of how your customer is solving this problem?

The reality is, even though you may be making them $23 million in the long run, if they can solve this problem with three new people in the business, the numbers aren’t going to stack up. Take a sanity check with your pricing before moving forward.

Once you’ve landed on a ballpark number for pricing, you need to test it. Unless 40% of your customers are telling you that the price is too high, you’re probably not charging enough. It’s usually better to err on the side of charging too high and negotiating down, rather than the other way around.

In the end, it comes down to trial-and-error for a little while until you get the data back and can truly understand the value of what your product is delivering to your customers. And when I say “data”, the most important information needs to come from the prospects that say “no”.

Why did they say no? Was it actually related to price, or to something else? You want to be able to measure and track why deals are falling over, and get underneath the surface-level excuses to see what is really going on.

Conversion Rates (CR%)

When referring to Conversion Rates (CR%) I’m looking at how many SQLs become actual paying customers. The industry standard conversion rate from SQL to sale is about 30-35%. If you’re not getting these results yet, then you need to start looking at either 1) other avenues for , or 2) optimizing your existing channels to improve your metrics.

You can look at those numbers from a couple of angles though.

Let’s say for example you are closing 50% of leads. That could be telling you that your criteria for qualifying a lead is too tight, or your price is too low, for example. However, it could also be an opportunity to expand your sales force and really start accelerating the activity you’re doing at the top of the funnel, so you can capitalise on what could be a hot market.

On the flip side, if your conversion rates are below that 30-35% threshold it should send off some alarm bells. The first place to look is your sales reps and their performance levels. What are they doing in their sales conversations? Are they truly identifying the need and the impact on the prospect’s business?

If you’re confident your sales reps are doing everything they can be to close these leads, then you need to start looking at the lead sources and your qualification criteria.

If you are tracking all of these components properly, they will start to influence the decisions you make in other areas. For example, you may want to find an ACV that delivers you a Conversion Rate of 30-35%. That’d be a good balance to strive for, as long as you are driving enough opportunities into the mix so that those numbers deliver your growth goals.

Deal Velocity, or Sales Cycle

So the final piece of the puzzle when it comes to systematically growing your sales is the Deal Velocity (In Days). This is a measurement of time between when the lead becomes an SQL and when the deal is won.

Your has a direct correlation with your ACV too. For example if you’re selling in the range between $10-50,000, you should be closing those deals within 20-100 days. Anything outside of that timeframe, then your ACV needs to be much higher, and your sales process becomes much less predictable and manageable.

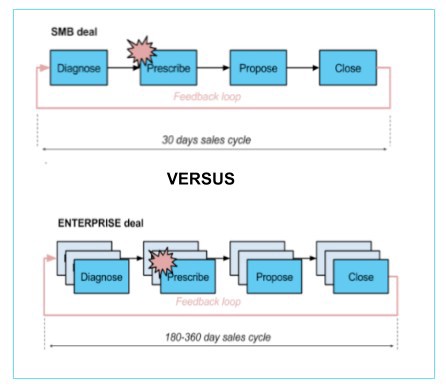

Here is a visual depicting the average difference in between a SMB deal and an Enterprise deal:

The key to reducing your Deal Velocity is to manage your sales process. You’ve got to be able to document your sales process from start to finish. When do you send your first email, when does the proposal get drafted, how long does each step take to complete?

By looking at each part of the sales process, you can measure the results of your and begin to iterate over time. You’ll soon figure out where things are being held up, where the bottlenecks are, and how you can remove them.

Conclusion

When you’re looking at these four basic metrics, you need to be able to measure and manage the process that influences each of them.

But a word of caution here: it’s not just about looking at these four metrics – you need to define and implement a cohesive , with a discrete , that helps each better understand how you can help them solve their pain points.

They are all interconnected. In fact, some of them have very strong connections to each other, such as ACV and Deal Velocity – they are inextricably linked.

If you’re able to document your sales process from lead acquisition all the way through to closing a deal, it will give you the opportunity to learn and identify opportunities to improve these key elements and better connect with each .