Jacco J. van der Kooij, Founder Winning by Design, Palo Alto, California

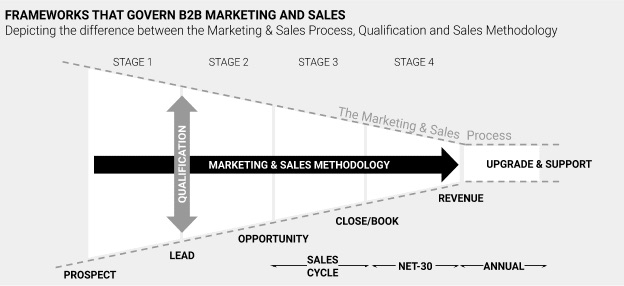

Traditional B2B marketing and sales frameworks such as the sales funnel, lead qualification and sales methodologies do not achieve the desired results in SaaS businesses.

Definition of the Frameworks

A sales methodology describes the process of how to acquire revenue, and a qualification methodology describes what you are going to measure. When you combine lead generation, lead qualification, and customer acquisition processes you get a system. In marketing and sales, this system historically has been referred to as the funnel. Recurring revenue models such as SaaS leverage a client’s success to create compound growth and need their own framework.

SaaS Sales Has Outgrown the Funnel

In 1898, Elias St. Elmo Lewis developed a model that mapped a theoretical customer journey from the moment a brand or product attracted consumer attention to the point of action or purchase. He created a four-stage process Awareness, Interest, Desire, and Action, or AIDA [Ref. 3.]. This term was popularized when enacted in a scene by Alec Baldwin in the movie Glengarry Glen Ross [Ref. 9.]. In the AIDA model, revenue and profits are realized shortly after the client signs on the line which is dotted.

Many sales and marketing organizations still use a derived version of AIDA today: Namely, the marketing and sales funnel. The lines between marketing and sales have blurred over the years, but the funnel and its shape remain the way how we describe and visualize the process. Around 2008, a new business model became popular, in which the upfront purchase and profits were exchanged in return for a recurring revenue stream.

Up to this point, software was sold using three to five-year contracts, measured in hundred thousand to millions of dollars, and often paid upfront.

The recurring counterpart of this model, which we now know as SaaS (Software as a Service), offered the exact same impact at a fraction of the price by replacing the perpetual revenue with a usage, monthly, quarterly or annual revenue. In the years that followed, a refined version of the opportunity stages became the basis of the sales funnel [Ref. 7].

Historically, there has always been a gap between the strategy and sales implementation [Ref. 4], but never more so than with a recurring revenue model. As you can see in Table 1, with the perpetual B2B model, 60% of the total revenue on a deal is secured on the win and the remaining 40%, from automatic upgrade and support renewals in future years. What is more telling is what happens in the recurring B2B model, where only 18% of the revenue is secured on the win.

Table 1. Distribution of revenue across five years of a perpetual sales model

| Perpetual | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Total | |

| Purchase price | $120,000 | $120,000 | |||||

| Upgrade & Support | 20% | $24,000 | $24,000 | $24,000 | $24,000 | $24,000 | |

| Annual Revenue | $144,000 | $24,000 | $24,000 | $24,000 | $24,000 | $240,000 | |

| % of total revenue | 60% | 10% | 10% | 10% | 10% |

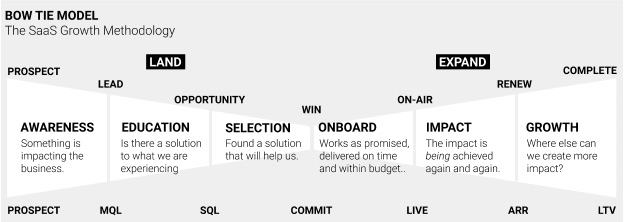

Table 2 shows that with a recurring model, 82% of the total revenue of a single deal comes from future revenues. The lion’s share of profit in this recurring B2B model has shifted beyond the original win [Ref. 10]. As a result, recurring sales have outgrown the traditional sales funnel. Businesses that are based on a recurring revenue stream require a new model. This model is referred to as the bowtie model.

Table 2. Distribution of revenue across five years of a recurring sales model

| Recurring | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Total | |

| Annual Price | $24,000 | $24,000 | $25,200 | $26,460 | $27,783 | $29,172 | |

| Annual Expansion* | 5% | $1,200 | $1,260 | $1,323 | $1,389 | $1,459 | |

| Annual Revenue | $25,200 | $26,460 | $27,783 | $29,172 | $30,631 | $139,246 | |

| % of total revenue | 18% | 19% | 20% | 21% | 22% |

*The different models provide a very different growth model. The perpetual model is for low volume/big deals, whereas recurring models grow at an accelerated rate due to its lower price and shorter-term contract.

The Bowtie Model

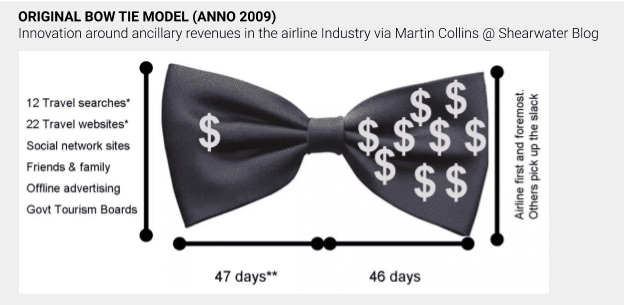

The origins of the bowtie model lie in the travel industry, where it has been used since its inception in 2009 [Ref. 20.]. In the bowtie model, the knot of the tie is the point at which a ticket purchase is made. To get to this point, the traveler has narrowed down the destination, date and price options, and made a purchase.

What follows is growth from ancillary revenue streams such as seat upgrades, baggage, rental car, and hotel but also credit card fees. Before 2009, there was no model for this, and thus no process to capture the ancillary revenues. Today ancillary revenues from credit card fees alone have become a billion-dollar business, and for many airlines, an important profit center [Ref. 5.].

A similar situation occurs in SaaS subscription businesses. In SaaS, the majority of the profits often occur 12 to 18 months following the original commitment [Ref. 1.]. Similarly, the traditional sales funnel does not model how to capture this future revenue.

If you apply the bowtie model to SaaS, it must cover three critical stages beyond the original commit: The installation stage aimed to achieve first impact; the impact stage where customers achieve the desired impact and the recurrence of the impact; and the activity of growing the business together with your client to expand the impact beyond its original scope.

The last two stages create a loop resulting in a compound growth engine. In comparison, a funnel was designed to achieve linear growth. To achieve compound growth, we differentiate between two different methodologies that are often confused with each other:

- A sales methodology – How to acquire the revenue

- A qualification methodology – What to measure and identify qualified opportunities

Let’s start with explaining what a sales methodology is.

Sales Methodologies Governing B2B Sales

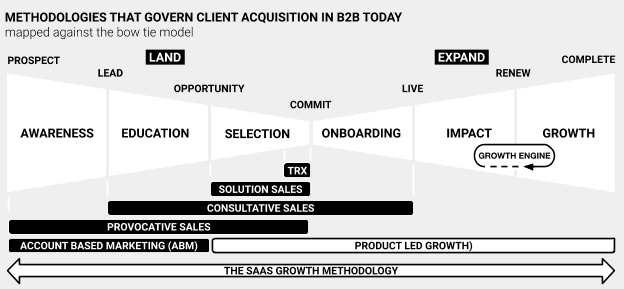

There are a number of B2B sales methodologies that govern B2B sales focusing on acquiring revenue. Mapping each of these methodologies against the bowtie model provides insights into how they differ.

Transactional Sales (TRX): A price/shipment-based sales methodology where the client prefers to have as little human involvement (preferably none) as possible. Think of buying something on Amazon. Price, simplicity, and speed of purchase are key decision factors.

Solution Sales [Ref. 14]: The client understands the problem very well and identified two to three options. The client is looking for a seller to answer a few pointed questions, one of which can be the decisive differences over competitors. When a company invested in a unique feature, feature selling is a must!

Consultative Sales [Ref. 15]: The client realizes they have a problem but does not understand the full impact the problem has on the business. Through a series of diagnostic questions, the seller establishes value across the organization and develops a sense of urgency to free up more budget and/or prioritize the budget.

Strategic Sales [Ref. 16]: Client does not realize they have a problem, and a seller – a true expert in this field – provokes a senior executive by reframing the problem or highlighting an immediate opportunity. The key is to get an executive buy-in early on, and to work with the client to identify the impact it can have on their business.

Account Based Marketing [Ref. 2]: When selling a commonly known solution to a commonly known problem (think of a CRM, ERP or MAS), the seller targets a number of decision-makers, influencers and advocates at hand-picked companies with personalized messages and content through marketing and advertising campaigns. It is key is to be relevant to each individual person.

It is important to realize that none of the aforementioned B2B sales methodologies actually address the compound growth engine which is critical to the growth of recurring revenue businesses. Instead, many revenue leaders maintain a maniacal focus on winning more deals, which ironically prevent them from growing the business at a fast rate.

Over recent years, there is one specific methodology that has actually leveraged the growth engine with great success and benefited from the compound impact it creates:

Product Led Growth [Ref. 12]: This is a B2C like methodology that can be used with a high-quality product and/or service experience in B2B. It encourages customers to contribute to marketing the product by using their own social networks to share and amplify the product. A basic example of this is giving a free month of service to an existing user if two of their friends sign up as well. The Product Led Growth (“PLG”) methodology applies to a business that is based on a high amount of deals per month with a low contract value. Key to this methodology is to have a high-quality product, and it further helps to have a very unique feature. Products such as Slack, Zoom, and recently Superhuman, are experiencing the benefits of this methodology. The downside is that this requires the momentum of 100,000s of users which doesn’t apply to most B2B applications and platforms.

Combining the above best practices, a new methodology can be designed for companies that sell B2B applications and platforms, at a much higher contract value, and are based on a recurring revenue business model.

SaaS Methodology: This methodology applies to B2B applications and platforms where a large percentage of the customer lifetime value is realized after the initial sale [Ref. 10]. This methodology modernizes and extends prior marketing and sales methodologies but does not replace them. It does so by adapting these methodologies to higher velocity sales cycles. The methodology includes the processes for demand generation and prospecting as well as post-sales processes such as customer success and account management. A hallmark of the SaaS methodology is to not only make a customer aware of an innovative way to solve the challenge they are experiencing, but to show the impact of the solution in a way that is coordinated and ongoing.

In recurring business, by definition, if a client churns before a profit is established, a loss is made. This makes calling on the right client extremely important. The process of calling on the right client historically is referred to as qualifying. Next, several qualification methodologies are described and how they differ compared to sales methodologies.

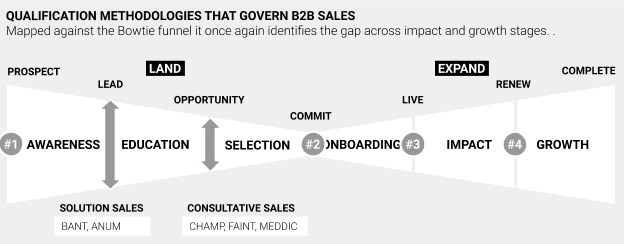

Qualification Methodologies That Govern B2B Sales

Think of a marketing and sales methodology as a treatment prescribed by a doctor. When you have an allergic reaction to poison oak, a doctor may prescribe you with a treatment to take two pills per day, right after a meal, for the next five days. In this example, the qualification methodology would be to establish if a) the treatment will have the desired impact, and b) if your body is able to deal with such a treatment.

The actions taken to qualify will likely include measurement of blood pressure, but also a response to a previous treatment. Today, qualification in the marketing and sales funnel happens mostly in two particular situations: lead qualification, and opportunity qualification.

BANT is one of the most frequently heard qualifications methodologies [Ref. 6]. It was originally developed by sales teams at IBM during the 60s. They used BANT to recognize buyers for their mainframe computers versus those who only wanted to see a demo of these enormous machines. BANT is an acronym for Budget, Authority, Need, and Timeline of the decision. Historically, BANT and other qualification methodologies such as ANUM, which stands for: authority, need, urgency, and money, match up well with the solution sales methodology [Ref 14].

CHAMP and FAINT [Ref. 8] are qualification methodologies that add qualifiers around the ability to identify challenges a client experiences and make it line-up well with the consultative sales methodology [Ref 15].

MEDDIC is perhaps the qualification methodology that is found the most common in recurring revenue businesses is MEDDIC [Ref. 11]. And for good reason, created by Dick Dunkel and Jack Napoli during the 90s, MEDDIC differs in that it adds a qualifier in identifying if an impact can be made on a client’s business.

There is no qualification method that is better or worse; what determines the success of any given qualification methodology is how it is applied. For example, using BANT to qualify a CEO in a provocative first-call is doomed for failure. In a similar vein, peppering a client with a series of questions while they are ready to buy is not going to yield the desired result either. What is missing is a qualification methodology that matches up with the subscription business. In particular:

#1. Does the client have an opportunity that can positively be impacted by the seller?

#2. Can the seller help the client achieve the impact in the timeframe the client needs it?

#3. With reasonable certainty, will the impact for the client result in a profit for the seller?

#4. What’s the growth potential beyond the original impact?

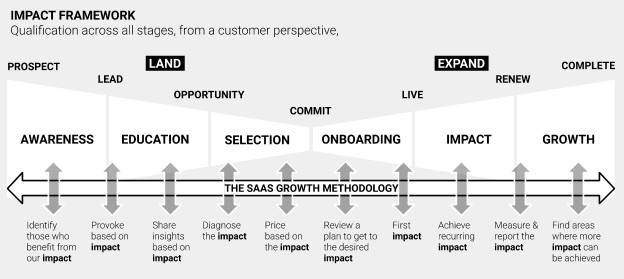

It’s clear to see what ties these four questions together: impact. Impact is the standardized qualifier that matches up with the SaaS methodology. Where recurring revenue is the result of recurring impact for the client.

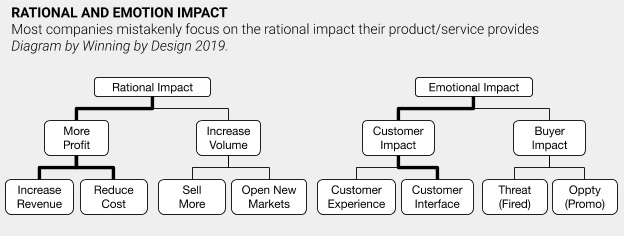

The Impact Framework

There are two ways that impact is perceived: 1) Rational Impact, which is measurable using facts and figures, and 2) Emotional Impact, which is mostly about feelings and experiences. Research shows that people tend to make an emotional decision then validate that decision with facts and figures [Ref. 18].

Emotional impact benefits an individual first, whereas rational impact benefits a corporation first. For example, if a decision results in one-million-dollar savings per year for a company, it is unlikely that the savings are going to find its way into the pocket of the decision-maker.

However, an automated dashboard will directly reduce headaches for the person manually creating reports every weekend. This means that sellers must not only identify their ideal customer profile, but also the type of impact that is most important to each person they are working with, and customer success must ensure this impact is achieved over time.

Organizations have to extrapolate the impact across all parts of the business using an Impact Framework that acts as a qualification framework across all stages.

Findings

Finding 1. The traditional B2B marketing and sales funnel and its qualification methodologies were built for a perpetual business and do not address the needs of a recurring business model (SaaS).

Finding 2. In SaaS, growth comes from recurring revenue. Recurring revenue is the result of recurring impact the customer experiences and is not the same as recurring usage as commonly measured by sellers.

Finding 3. To help customers accomplish a recurring impact, additional stages must be added to the process. Recommended stages to add are: Achieve Recurring Impact and Growth of Impact. This is depicted with a bowtie.

Finding 4. All customer-facing roles must work of the same uniform methodology across all roles and departments, not one that is dictated by one department or is based on the use of a specific software tool.

Finding 5. Qualification is not something that should happen once but throughout the entire process. The qualification methodology must match the sales methodology. For businesses dependent on recurring revenue, an impact-based framework is recommended.

Suggested Actions

Here are a few suggested steps:

Action 1. Bring together a team of representatives from all customer-facing roles to help identify the Rational and Emotional Impacts

Action 2. For each department, create a plan to qualify based on the impact and what action to take.

Action 3. Create a hand-off process between departments based on Impact

Action 4. Codify the agreed actions for each department into your tool stack.

Action 5. Measure and report the number of new leads generated by existing clients.

References

Ref. 1. 2018 Expansion SaaS Benchmark (slide 30) – By K. Poyar and S. Fanning of Openview Advisors

Ref. 2. Account Based Marketing by Wikipedia

Ref. 3. AIDA Definition by Wikipedia

Ref. 4. Aligning Strategy and Sales: The Choices, Systems and Behaviors that Drive Effective Selling by Frank V. Cespedes via Amazon

Ref. 5. Airlines Make More Money Selling Miles Than Seats, by J. Bachman, June 2017, via Bloomberg

Ref. 6. BANT Opportunity Identification Criteria by IBM

Ref. 7. What is a Sales Funnel? (And How is it Changing?) via The 360 Blog, salesforce.com

Ref. 8. FAINT – The New Definition of a Qualified Prospect by Mike Schultzs, via RAIN Group blog

Ref. 9. Glengarry Glen Ross, An examination of the machinations behind the scenes at a real estate office. Released Oct. 2, 1992 by Newline Cinema

Ref. 10. How Adobe, GoPro, Microsoft, and Gillette Saved Their Businesses Through Subscription Revenue by PriceIntelligently via blogpost

Ref. 11. MEDDIC Definition by SalesMeddic via their website www.salesmeddic.com

Ref. 12. Leading with your product is the most effective GoToMarket Strategy by M. Alon via Slideshare

Ref. 13. Seven Sales Qualification Methodologies by Jeremy Donovan via Slideshare

Ref. 14. Solution Selling Definition and Research by Nadia Landman via blogpost on web-site

Ref. 15. SPIN Selling by Neil Rackham via Amazon

Ref. 16. The Strategic Sales: Taking Control of the Customer Conversation by Matthew Dixon and Brent Adamson via Amazon

Ref. 17. The Power of Habit: Why We Do What We Do In Life and Business by Charles Duhigg via Amazon

Ref. 18. The Power of Persuasion: How We’re Bought and Sold by R. Levine published in 2003 via Amazon

Ref. 19. The SaaS Sales Method: Sales as a Science, by Jacco J. van der Kooij, via Amazon

Ref. 20. Updated Bow Tie and Lead Time Numbers by Martin Collings via Shearwater Blog May 14, 2009

Ref. 21. Why CHAMP is the new BANT. – By InsightSquared, via Blogpost.